Did you know that private equity firms leveraging a robust Customer Relationship Management (CRM) system can enhance their deal sourcing by up to 40%? In the competitive landscape of private equity, where every lead and relationship count, the right CRM can be a game-changer.

As a seasoned CRM expert, my goal in this article is to guide you through the best CRM solutions tailored specifically for private equity firms. We’ll compare top CRM systems, delve into their key features, pricing structures, and explore the best use cases to help you make an informed decision.

Selecting the right CRM is not just a technical decision—it’s a strategic one. For private equity firms, a CRM system can streamline operations, enhance investor relations, and ultimately drive profitability. The right CRM facilitates better data management, improved communication, and efficient workflow automation, all of which are critical for sustained success in the private equity sector.

In this comprehensive guide, we’ll cover the essential features to look for in a private equity CRM, review the top CRM solutions available, provide recommendations based on different business needs, and offer a detailed buying guide for beginners. Additionally, we’ll address frequently asked questions to clear any lingering doubts you may have about implementing a CRM in your private equity firm.

Why CRM is Essential for Private Equity Success?

CRM systems are essential for tracking interactions, maintaining relationships, and managing the vast amounts of data that private equity firms handle daily. Selecting the best CRM for private equity is critical for success, as it can streamline your processes, improve decision-making, and allow you to focus on what matters most—securing the best deals and managing relationships effectively.

In this guide, we’ll explore the essential features of a CRM for private equity and provide recommendations for the best solutions available in the market today.

What to Look for in a CRM for Private Equity?

In the dynamic world of private equity, your business needs can evolve rapidly. It’s imperative to choose a CRM that can scale alongside your firm, accommodating an increasing number of deals, investors, and data points without compromising performance. A scalable CRM ensures that as your portfolio grows, your CRM system can handle the additional load, providing consistent performance and reliability.

Scalability

In the dynamic world of private equity, your business needs can evolve rapidly. It’s imperative to choose a CRM that can scale alongside your firm, accommodating an increasing number of deals, investors, and data points without compromising performance. A scalable CRM ensures that as your portfolio grows, your CRM system can handle the additional load, providing consistent performance and reliability.

Ease of Use

A CRM’s effectiveness is directly tied to how easily your team can adopt and utilize it. An intuitive interface and a straightforward onboarding process are crucial, especially for small teams or those new to CRM systems. A user-friendly CRM minimizes the learning curve, encourages widespread adoption, and ensures that your team can leverage the system’s full potential without extensive training.

Customization

Every private equity firm has unique workflows and requirements. The ability to customize your CRM to fit these specific needs is essential. Whether it’s tailoring data fields, creating custom reports, or integrating specific workflows, a customizable CRM allows you to align the system with your firm’s operational nuances, enhancing efficiency and productivity.

Integration Capabilities

A CRM should seamlessly integrate with other essential tools and software your firm uses, such as email marketing platforms, accounting software, and data analytics tools. Robust integration capabilities ensure that data flows smoothly between systems, eliminating silos and providing a unified view of your operations. This interconnectedness is vital for maintaining data integrity and enabling comprehensive analysis.

Top 5 CRMs for Private Equity Firms

1. HubSpot CRM

HubSpot CRM is a powerful and intuitive platform designed to help businesses manage their relationships, streamline workflows, and improve deal tracking. It is particularly known for its ease of use and extensive integration capabilities, making it ideal for private equity firms looking to efficiently manage investor relations and portfolio companies.

Key Features:

- Contact and Deal Management: Organize and track communications with investors and stakeholders, ensuring no interaction is missed.

- Customizable Deal Pipelines: Tailor the deal tracking process to fit private equity workflows, improving deal flow and management efficiency.

- Email Integration & Automation: Automate follow-ups and marketing efforts, saving time while keeping stakeholders engaged.

- Reporting & Analytics: Access detailed reports on deal progress and performance, offering data-driven insights for better decision-making.

- Integration Capabilities: Seamlessly integrates with tools like accounting software and email marketing platforms to create a unified system.

Pricing:

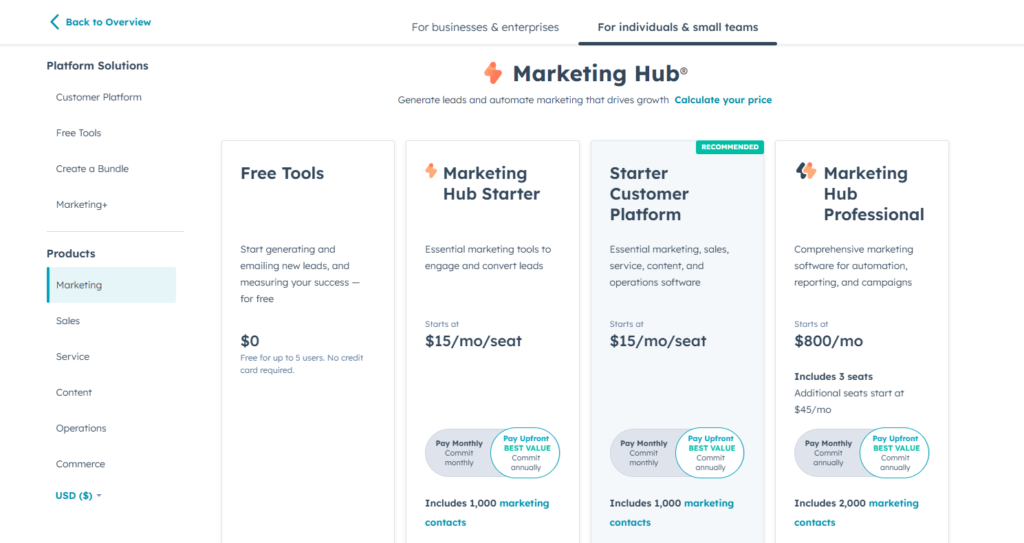

- Free Plan: $0 for core features (basic CRM, deal tracking, and contact management).

- Starter: $15/month (includes basic sales tools, email automation).

- Professional: $800/month (advanced marketing automation, custom reporting, and analytics).

- Enterprise: $3,600/month (premium features like custom objects and sophisticated reporting tools).

HubSpot CRM is ideal for small to mid-sized private equity firms that need a scalable, user-friendly solution. Its free and starter plans are great for firms with basic CRM needs, while the higher-tier plans cater to larger firms requiring advanced automation, reporting, and customization features.

2. Salesforce

Salesforce CRM is one of the most powerful and widely used platforms globally. It offers extensive features, scalability, and customization, making it a top choice for private equity firms. Its cloud-based infrastructure and advanced automation capabilities allow firms to manage investor relations, track deals, and analyze performance at scale.

Key Features:

- Customizable Dashboards: Create personalized dashboards to monitor investor relations, portfolio performance, and deal flow, providing real-time insights.

- AI-Powered Analytics (Einstein Analytics): Leverage AI to forecast deal success and analyze investor behavior, helping private equity firms make smarter decisions.

- AppExchange Integrations: Access thousands of third-party apps for seamless integration with accounting, marketing, and project management tools.

- Automation & Workflows: Automate repetitive tasks such as investor communications, follow-ups, and deal updates, improving efficiency.

- Collaboration Tools: Use built-in tools to collaborate on deals and investor communications across teams, ensuring alignment and transparency.

Pricing:

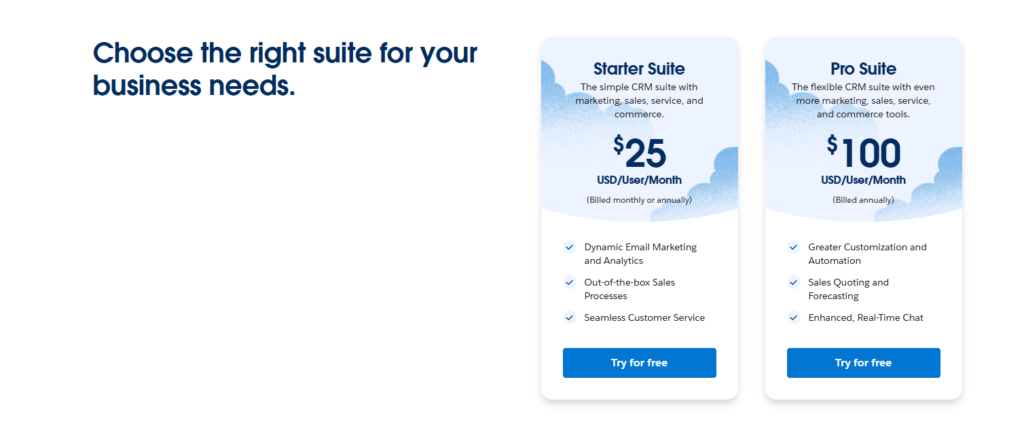

- Essentials: $25/month per user (basic CRM features for small teams).

- Professional: $75/month per user (complete CRM for any size business).

- Enterprise: $150/month per user (advanced customization and automation).

- Unlimited: $300/month per user (unlimited support and extensive customization).

Salesforce CRM is best suited for large private equity firms that need extensive customization, scalability, and advanced analytics. Its AI-powered features and ability to integrate with a wide range of third-party tools make it ideal for firms that handle complex deal flows and require in-depth insights.

3. Pipedrive CRM

Pipedrive is a sales-focused CRM designed to help businesses manage deals and relationships efficiently. Its visual pipeline interface makes it particularly effective for private equity firms that need a clear, structured way to manage deal flow and investor communications.

Key Features:

- Visual Pipeline Management: Offers an easy-to-understand, drag-and-drop interface for tracking deals at each stage of the pipeline, ideal for managing complex private equity deals.

- Customizable Workflow Automation: Automate repetitive tasks like follow-ups and deal updates, freeing up time for more critical tasks.

- Activity Reminders: Ensures that no communication or deal milestone is missed, keeping private equity teams on top of tasks.

- Integration with Third-Party Tools: Works seamlessly with platforms like Google Workspace, email tools, and financial software, creating a streamlined workflow.

- Reporting & Analytics: Provides clear insights into deal success rates, pipeline progress, and team performance, helping private equity firms make informed decisions.

Pricing:

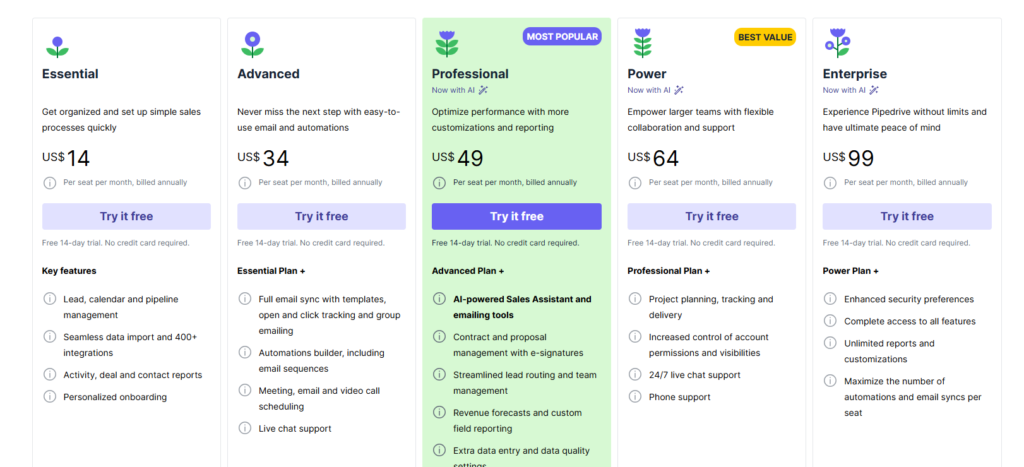

- Essential Plan: $14/month per user (basic CRM features and pipeline management).

- Advanced Plan: $34/month per user (email integration, automation features).

- Professional Plan: $49/month per user (advanced automation, performance insights).

- Power Plan: $64/month per user (team collaboration and deeper customization).

- Enterprise Plan: $99/month per user (high-level security, customization, and support).

Pipedrive is best suited for small to medium-sized private equity firms that prioritize deal flow management and need an intuitive, visually structured CRM. Its affordable pricing and simple interface make it ideal for firms that need strong deal-tracking capabilities without the complexity of larger systems.

4. Keap CRM

Keap (formerly known as Infusionsoft) is a robust CRM and automation platform focused on helping businesses streamline operations through automated marketing, sales, and contact management. While traditionally favored by small businesses, its automation capabilities make it valuable for private equity firms looking to efficiently manage investor relationships and communications.

Key Features:

- Automation Workflows: Automate repetitive tasks like follow-up emails, deal tracking, and appointment scheduling, which can save private equity teams significant time.

- Customizable Pipelines: Tailor pipelines for deal management, ensuring a clear view of each stage in the investment process.

- Email & SMS Marketing: Use integrated email and SMS campaigns to keep investors informed and engaged, a critical feature for private equity communications.

- Lead Scoring & Tagging: Prioritize investor leads and deals based on engagement, helping firms focus on high-value relationships.

- Appointment Management: Schedule and track meetings with investors and portfolio companies through a streamlined booking system.

Pricing:

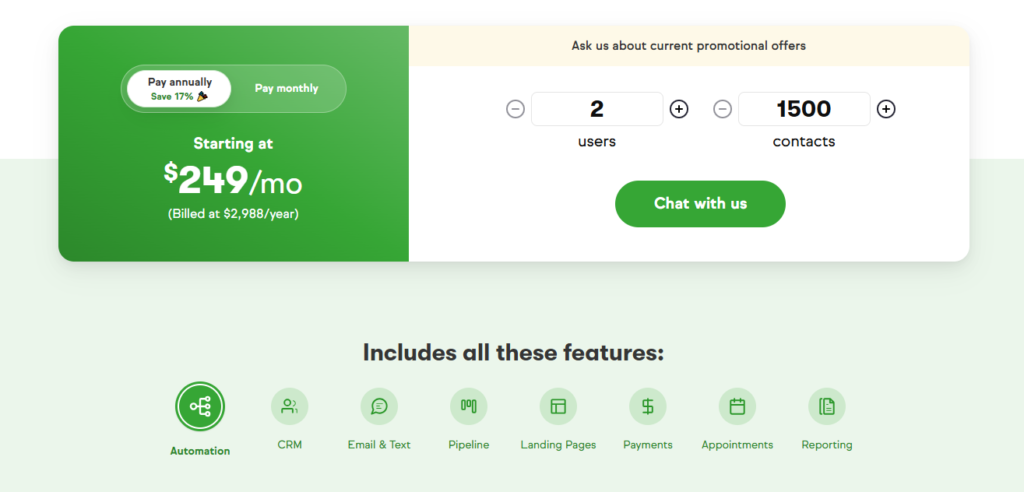

- Keap Pro: $299/month for 1,500 contacts and 2 users (additional costs for more contacts/users).

Keap is best suited for small to medium-sized private equity firms or representatives who require extensive automation for managing investor communications and deal tracking. It is particularly beneficial for firms that rely heavily on email and SMS marketing to engage stakeholders and want a CRM that automates these processes efficiently.

5. Zoho CRM

Zoho CRM is a comprehensive and affordable solution that provides a wide range of features for managing relationships, deals, and workflows. It’s highly customizable and scalable, making it suitable for private equity firms of all sizes. With its robust automation, reporting, and integration capabilities, Zoho CRM is an ideal tool for firms looking to streamline operations and improve deal flow management.

Key Features:

- AI-Powered Analytics (Zia): Leverages AI to provide insights on deals, helping private equity firms make data-driven decisions on investments and portfolio management.

- Customizable Pipelines: Tailor pipelines to track deal progress and investor relations, offering a flexible solution for unique private equity workflows.

- Automation: Automate tasks like follow-ups, emails, and investor updates, saving time and improving operational efficiency.

- Integration with Third-Party Apps: Integrates with a wide range of tools such as accounting software, email marketing platforms, and project management tools, creating a seamless experience.

- Advanced Reporting: Provides detailed reporting on deals, investor engagement, and overall firm performance, helping private equity firms track key metrics.

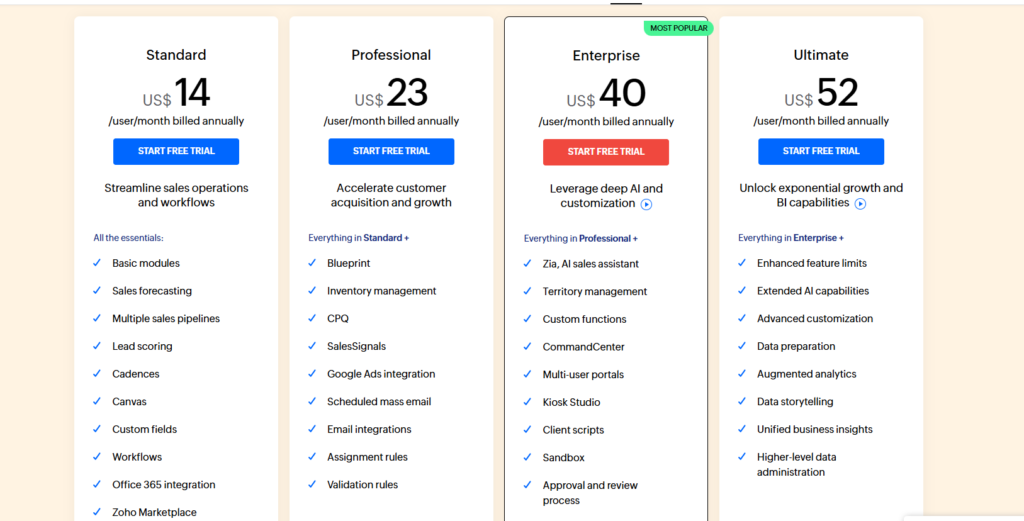

Pricing:

- Standard: $14/month per user (basic CRM features).

- Professional: $23/month per user (includes workflow automation, custom reports).

- Enterprise: $40/month per user (advanced customization, AI features, and deep analytics).

- Ultimate: $52/month per user (premium features, higher storage, advanced AI, and analytics).

Zoho CRM is ideal for private equity firms that require flexibility, scalability, and affordability. It’s particularly suited for mid-sized firms that need strong reporting, customization, and automation features. The wide range of pricing options makes it accessible to both smaller firms with limited needs and larger firms requiring more advanced functionality.

Which CRM is Best for Your Private Equity Firm?

After evaluating the key factors critical for private equity firms—such as scalability, ease of use, customization, and integration capabilities—Salesforce stands out as the Best CRM for private equity. Its extensive customization options, robust integration capabilities, and scalability make it an ideal choice for firms looking to optimize their operations and drive growth.

Use Case Recommendations:

- For Startups and Small Firms: HubSpot CRM provides an intuitive interface and essential features without overwhelming complexity, ideal for smaller teams.

- For Firms Seeking Affordability: Zoho CRM offers a cost-effective solution with a wide range of features, perfect for firms mindful of their budget.

- For Sales-Driven Private Equity Firms: Pipedrive focuses on sales pipeline management, making it ideal for firms that prioritize deal sourcing and sales activities.

Next Steps:

Ready to transform your private equity operations with a top-tier CRM? Start by signing up for a free trial or scheduling a demo with your chosen CRM provider. Explore the features, assess how they align with your firm’s needs, and take the first step towards enhanced efficiency and growth.

How to Choose the Best CRM for Private Equity: A Buying Guide?

Choosing the right CRM can seem daunting, especially for beginners. Here’s a step-by-step guide to help you navigate the process:

- Identify Your Business Needs:

- Assess your firm’s specific requirements. Do you need advanced data analytics, robust deal tracking, or seamless investor management?

- Evaluate Key Features:

- Look for features that align with your needs, such as customization options, integration capabilities, automation tools, and reporting functionalities.

- Consider Scalability:

- Ensure the CRM can grow with your business. Evaluate whether it can handle an increasing volume of data, users, and transactions as your firm expands.

- Assess Ease of Use:

- Opt for a CRM with an intuitive interface. A user-friendly system reduces the learning curve and encourages team-wide adoption.

- Review Integration Options:

- Check if the CRM integrates with other tools you use, such as email marketing platforms, accounting software, and data analytics tools.

- Compare Pricing Structures:

- Understand the pricing models of different CRMs. Consider factors like subscription fees, additional costs for premium features, and scalability of pricing as your needs grow.

- Test Customer Support:

- Reliable customer support is crucial. Ensure the CRM provider offers comprehensive support, including tutorials, live chat, and dedicated account managers.

- Read Reviews and Case Studies:

- Research feedback from other private equity firms. Case studies can provide insights into how the CRM performs in real-world scenarios.

- Start with a Free Trial:

- Take advantage of free trials to explore the CRM’s features and assess its suitability for your firm before committing.

- Make an Informed Decision:

- Based on your evaluation, choose the CRM that best aligns with your business needs, budget, and long-term goals.

Conclusion

Selecting the Best CRM for your private equity firm is a pivotal decision that can significantly impact your operational efficiency, investor relations, and overall success. By focusing on scalability, ease of use, customization, and integration capabilities, you can choose a CRM that not only meets your current needs but also adapts as your firm grows.

When choosing a CRM, consider not just your immediate requirements but also your long-term business goals. A CRM is an investment in your firm’s future, so prioritize systems that offer flexibility and robust support to ensure sustained growth and efficiency.

Ready to elevate your private equity operations with the Best CRM solutions? Explore the options mentioned above by signing up for a free trial or scheduling a demo today. Enhance your deal sourcing, streamline your workflows, and drive your firm’s success with the right CRM.

FAQs

1. Do I really need a CRM?

Absolutely. In the competitive landscape of private equity, a CRM system helps you manage relationships, streamline operations, and make data-driven decisions, ultimately enhancing your firm’s efficiency and profitability.

2. How secure is my data in a CRM?

Reputable CRM providers prioritize data security, offering features like encryption, regular backups, and compliance with industry standards. Always review the security measures of a CRM before implementation to ensure your data remains protected.

3. Can a CRM integrate with my existing tools?

Most top-tier CRMs offer extensive integration capabilities with a wide range of tools, including email marketing platforms, accounting software, and data analytics tools. Ensure the CRM you choose supports the specific integrations you require.

4. What is the cost of implementing a CRM system?

CRM costs vary widely based on features, number of users, and scalability. Entry-level CRMs might start as low as $12 per user per month, while more comprehensive solutions like Salesforce can range from $25 to $300 per user per month. It’s essential to assess your budget and choose a CRM that offers the best value for your investment.

5. How long does it take to set up a CRM?

The setup time depends on the CRM’s complexity and the level of customization required. Basic setups can be completed within a few days, while more complex implementations with extensive customizations might take several weeks. Planning and phased implementation can help streamline the process.

6. What are the benefits of using a CRM for private equity?

A CRM enhances deal sourcing, improves investor relations, streamlines operations, and provides valuable data insights. These benefits collectively contribute to increased efficiency, better decision-making, and higher profitability.

7. Can a CRM help with compliance and reporting?

Yes, many CRMs offer features that assist with compliance and reporting, including data tracking, audit trails, and customizable reporting tools that help you adhere to industry regulations and generate necessary reports with ease.

8. How customizable are CRM systems for private equity?

Most CRM systems offer a high degree of customization, allowing you to tailor data fields, workflows, reports, and integrations to fit your firm’s specific needs. This flexibility ensures that the CRM aligns perfectly with your operational requirements.

9. What support options are available with CRM providers?

CRM providers typically offer a range of support options, including live chat, email support, phone support, and extensive knowledge bases. Some also provide dedicated account managers and personalized onboarding assistance to ensure a smooth implementation process.

10. Is training required to use a CRM effectively?

While many CRMs are designed to be user-friendly, some training can help your team leverage the system’s full potential. Most providers offer training resources, including tutorials, webinars, and documentation, to facilitate effective usage.

By following this guide, private equity firms can navigate the complexities of selecting and implementing a CRM system that not only meets their current needs but also supports their long-term growth and success. As CRM Expert, I encourage you to take the next step towards optimizing your operations with the best CRM for private equity.

I’m Palash Pramanik, an SEO and CRM expert with a deep passion for helping businesses thrive online. I specialize in driving higher search engine rankings and creating seamless customer relationship management strategies to enhance both visibility and engagement. Whether you need to boost your online presence, attract the right audience, or streamline your client interactions, I offer tailored solutions designed to meet your specific needs. My goal is to help you optimize your digital strategy, strengthen customer connections, and drive sustainable growth. Let’s work together to elevate your business to new heights!