Did you know that businesses using a CRM system experience a 29% increase in sales? In today’s competitive landscape, Customer Relationship Management (CRM) systems have become indispensable tools for businesses striving to enhance their customer interactions, streamline operations, and drive growth. As Palash Pramanik, a seasoned CRM expert, I have witnessed firsthand how the right CRM can transform a business’s approach to managing customer relationships and optimizing performance.

Introduction

The objective of this article is to provide a comprehensive comparison of the best CRM solutions tailored specifically for accounting firms. Whether you’re a small accounting practice or a large firm, selecting the right CRM can significantly impact your efficiency, client satisfaction, and overall success.

Choosing the right CRM is pivotal for achieving business success. For accounting firms, a robust CRM system can enhance customer retention, streamline operations, and provide valuable insights into client behaviors and preferences. A well-implemented CRM can help your firm maintain strong relationships with clients, manage leads effectively, and automate routine tasks, allowing you to focus on delivering exceptional accounting services.

In this article, we will delve into the top CRM solutions that are best suited for accounting firms. We will explore key features, pricing structures, and ideal use cases for each CRM, helping you make an informed decision. Additionally, we will discuss what to look for in a CRM for your business, provide a detailed buying guide, and answer some frequently asked questions to ensure you have all the information you need to select the best CRM for your accounting firm.

What to Look for in a CRM for Your Business

Scalability

One of the most critical factors to consider when selecting a CRM is scalability. As your accounting firm grows, your CRM should be able to accommodate increasing data volumes and user demands without compromising performance. A scalable CRM ensures that you won’t outgrow your system, saving you from the hassle and cost of switching to a new platform in the future. Look for CRM solutions that offer flexible pricing plans and the ability to add more features or users as your business expands.

Ease of Use

The necessity of an intuitive interface and a straightforward onboarding process cannot be overstated, especially for small teams or those new to CRM systems. An easy-to-use CRM minimizes the learning curve, allowing your team to quickly adopt and effectively utilize the system. Features like drag-and-drop functionality, customizable dashboards, and user-friendly navigation are essential. Additionally, consider CRM providers that offer comprehensive training resources and responsive customer support to assist your team during the transition.

Customization

Every accounting firm has unique workflows and requirements. Therefore, the need for customizable features is paramount when selecting a CRM. A flexible CRM allows you to tailor the system to match your specific business processes, whether it’s managing client data, tracking interactions, or generating reports. Look for CRM solutions that offer customizable fields, workflows, and integration capabilities to ensure the system aligns perfectly with your firm’s needs.

6 Best CRM Solutions for Accounting Firms

Selecting the best CRM for your accounting firm involves evaluating various options based on your specific needs. Here are six top CRM solutions that stand out in the market:

1. Keap CRM

Keap (formerly Infusionsoft) is a CRM designed specifically for small businesses, offering an all-in-one solution that includes email marketing, sales automation, and customer relationship management. Its focus on automation and simplicity makes it a great tool for small accounting firms looking to streamline their operations.

Key Features:

- Client Management: Centralized platform to manage client information, making it easy for accountants to track all interactions, documents, and client histories.

- Automated Follow-Ups: Automatically send follow-up emails, reminders for unpaid invoices, and notifications for upcoming deadlines, helping accounting firms maintain client engagement.

- Email Marketing & Campaigns: Build and automate email marketing campaigns to keep clients updated with tax tips, service offerings, or newsletters.

- Appointment Scheduling: Integrated scheduling tools allow clients to book appointments, reducing back-and-forth communication and saving time for accountants.

- Invoicing & Payment Tracking: Generate invoices and track payments, with options for automated payment reminders, making cash flow management easier for accounting firms.

- Sales Pipeline Automation: Helps accountants track new leads and potential clients, ensuring no opportunities slip through the cracks.

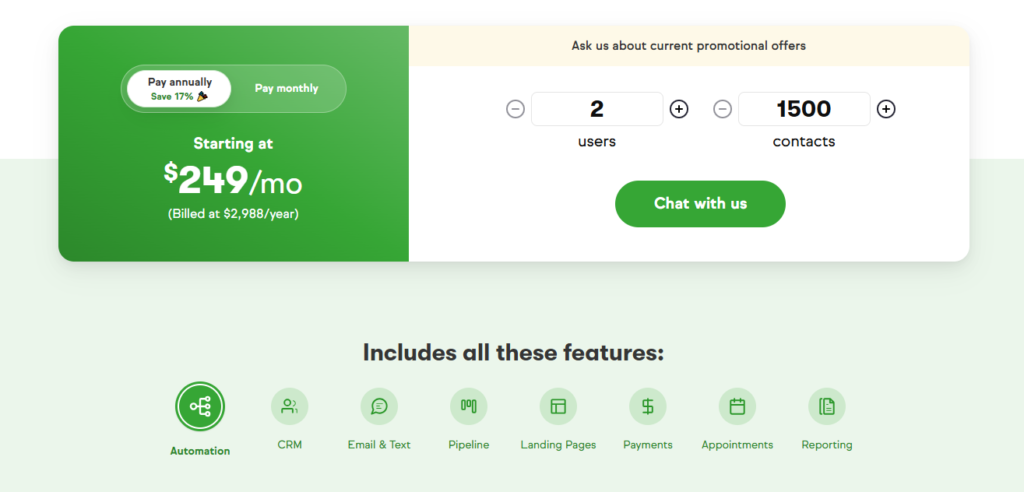

Pricing:

- Keap Pro: $249/month for 1,500 contacts and 2 users (includes CRM, automation, and email marketing tools).

Small accounting firms or solo practitioners that need a streamlined, automated CRM solution to manage client relationships, automate communications, and handle invoicing. Keap is ideal for firms looking to save time on repetitive tasks like follow-ups and appointment scheduling while also engaging clients with email marketing.

2. Salesforce CRM

Salesforce is one of the most widely-used CRM platforms globally, offering a robust suite of tools that helps businesses manage customer relationships, automate workflows, and enhance productivity. It is highly customizable and suitable for organizations of all sizes across various industries, including accounting.

Key Features:

- Client and Account Management: Comprehensive client profiles that include all interactions, allowing accountants to maintain a clear overview of client needs and services.

- Customizable Dashboards & Reports: Create detailed, customizable reports and dashboards to monitor client data, making it easier to track KPIs, profitability, and overall business health.

- Automation of Workflows: Automate routine tasks like follow-ups, invoicing, and reminders, enabling accounting firms to focus on billable work.

- Integration with Financial Tools: Seamlessly integrates with accounting platforms such as QuickBooks and Xero, streamlining financial data management.

- Collaboration Tools: Share client information and collaborate on documents with team members, increasing productivity for firms with multiple accountants.

- Lead & Opportunity Management: Track new business leads and opportunities to ensure no potential client is overlooked.

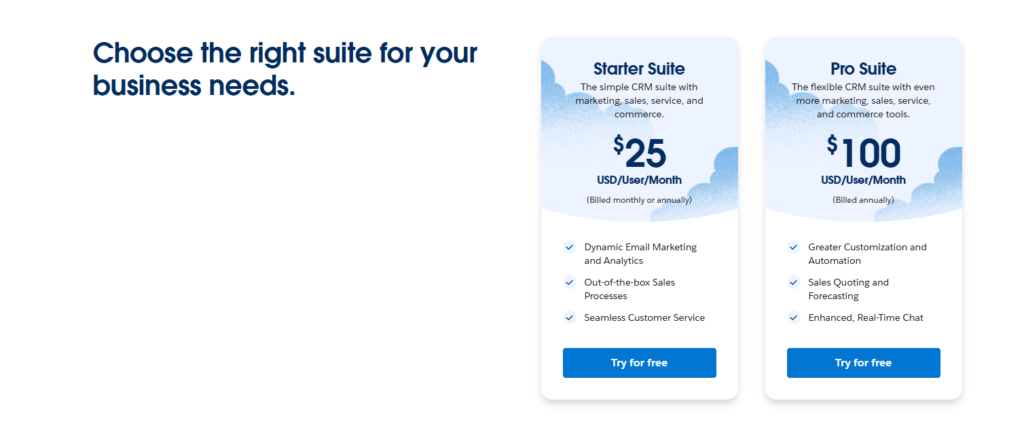

Pricing:

- Essentials: $25/user/month (basic CRM for small teams).

- Professional: $75/user/month (adds full CRM functionality).

- Enterprise: $150/user/month (includes advanced customization and automation tools).

- Unlimited: $300/user/month (unlimited support and extensive features).

Medium to large accounting firms that need highly customizable CRM solutions to manage complex workflows, reporting, and client data. Firms that want in-depth automation and scalability would benefit most from Salesforce, particularly those with larger client bases or teams.

3. HubSpot CRM

HubSpot CRM is a cloud-based customer relationship management software designed to help businesses organize, track, and manage customer interactions. Its user-friendly interface, free tier, and powerful marketing, sales, and customer service tools make it a popular choice for businesses of all sizes.

Key Features:

- Contact Management: Organize and track all client interactions and activities in a single dashboard, ideal for maintaining accurate records for accounting clients.

- Task Automation: Automate repetitive tasks such as follow-up emails and reminders, which saves time for accountants.

- Sales Pipeline Management: Helps accounting firms monitor and manage potential client leads from initial inquiry to service agreement.

- Email Tracking & Templates: Track client email interactions, and send professional templates for client communication.

- Reporting Dashboard: Generate detailed reports on client activity and business performance, assisting in identifying profitable clients.

- Integration with Accounting Tools: Integrates with tools like QuickBooks and Xero, making financial data synchronization seamless.

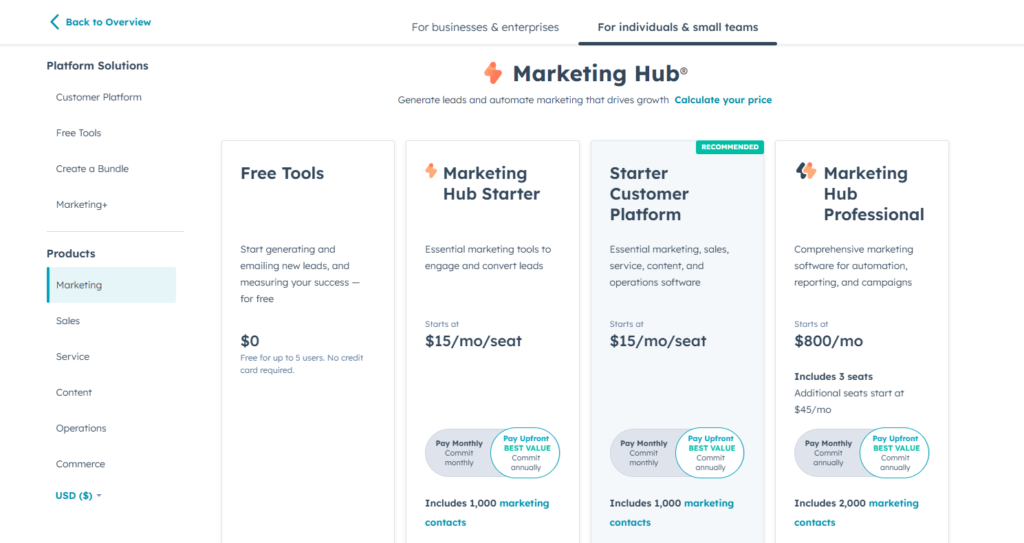

Pricing:

- Free Plan: $0 for core CRM features.

- Starter: $15/month (adds more advanced tools like meeting scheduling and marketing emails).

- Professional: $800/month (includes marketing automation, custom reporting, and more).

- Enterprise: $3,600/month (offers advanced reporting, multiple teams, and custom objects).

Small to medium-sized accounting firms seeking a free or low-cost CRM with marketing and sales features. Larger firms or firms with more advanced automation needs would benefit from the Professional or Enterprise plan.

4. Zoho CRM

Zoho CRM is a cloud-based CRM platform designed for small to medium-sized businesses, offering a broad range of tools to manage customer relationships, automate workflows, and track leads. Its affordability and customization options make it a popular choice for many industries, including accounting firms.

Key Features:

- Client Management: Store and manage all client interactions in one place, helping accounting firms keep track of communication history, service agreements, and client preferences.

- Workflow Automation: Automate routine tasks such as follow-ups, invoicing, and reminders, saving accountants time and increasing efficiency.

- Customizable Dashboards & Reporting: Tailor reports to monitor client data, project profitability, and key performance indicators.

- Email Integration & Automation: Integrate with Gmail, Outlook, and other email clients, with the ability to automate marketing emails, reminders, and follow-ups for clients.

- Document Management: Manage and share financial documents securely, making collaboration easier for accounting firms.

- Integration with Accounting Tools: Integrates with accounting software like QuickBooks, enabling seamless syncing of financial data.

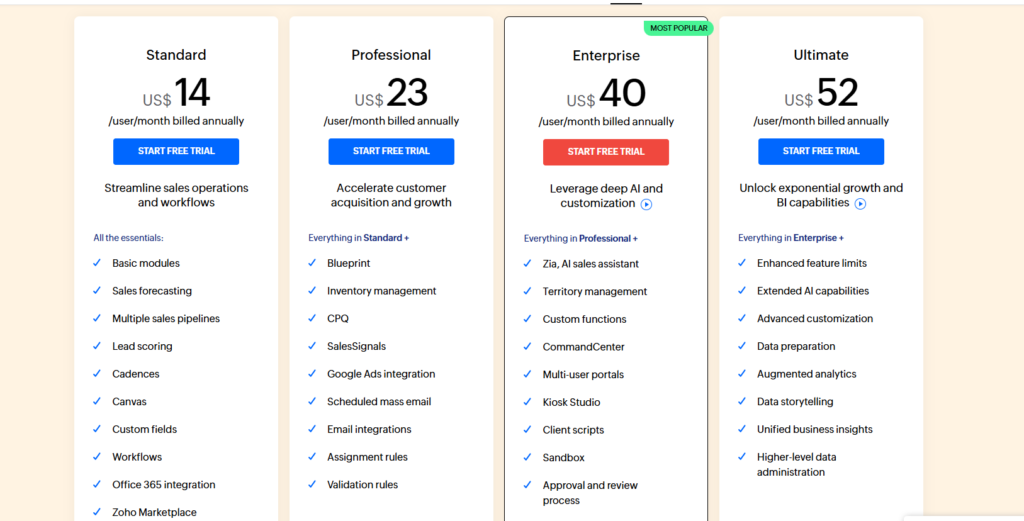

Pricing:

- Free Edition: Limited features for up to 3 users.

- Standard: $14/user/month (basic CRM features).

- Professional: $23/user/month (adds workflow automation and inventory management).

- Enterprise: $40/user/month (includes advanced customization and AI-based predictions).

- Ultimate: $52/user/month (includes enhanced analytics, premium support, and other advanced features).

Small to mid-sized accounting firms looking for an affordable, customizable CRM with essential features like workflow automation, email integration, and reporting. Firms that prioritize affordability and require integration with popular accounting tools will find Zoho CRM a suitable option.

5. Pipedrive CRM

Pipedrive is a sales-focused CRM that emphasizes simplicity and ease of use, making it ideal for businesses that want to prioritize managing leads and tracking deals through the sales pipeline. For accounting firms, it offers intuitive tools to manage client relationships, track potential leads, and organize workflows efficiently.

Key Features:

- Visual Sales Pipeline: A clear, visual interface that helps accounting firms track leads, inquiries, and new clients from initial contact to signed contracts, ensuring nothing is missed.

- Customizable Pipelines: Tailor sales and client management pipelines to fit the unique stages of accounting services, making it easier to manage new clients, ongoing services, and renewals.

- Task Automation: Automate repetitive tasks like sending follow-up emails or reminders, improving productivity by reducing manual effort.

- Email Integration & Tracking: Syncs with email providers, allowing accountants to track client emails directly within the CRM and ensure timely follow-ups.

- Reporting & Insights: Generate custom reports to monitor the performance of lead generation, client acquisition, and service delivery, helping firms measure growth and client profitability.

- Mobile Access: The mobile app allows accounting professionals to access client information and manage tasks on the go, enhancing flexibility.

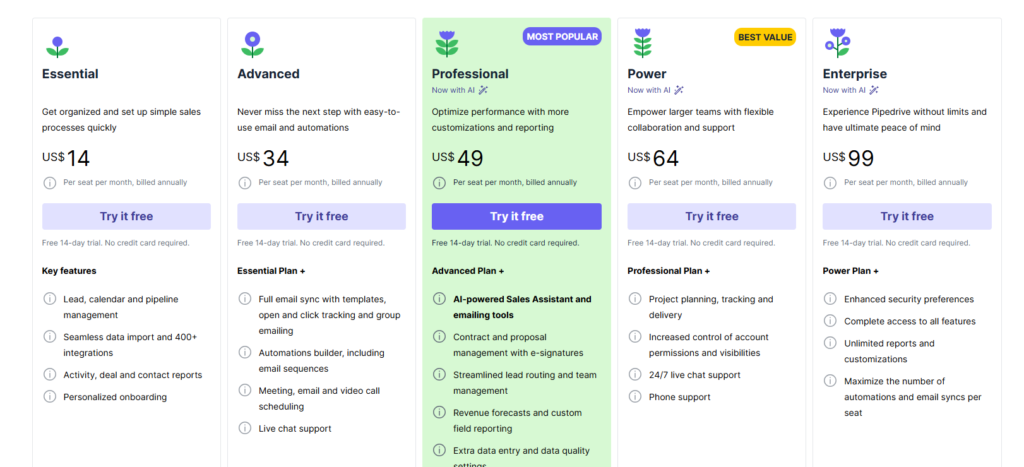

Pricing:

- Essential Plan: $14/month per user (basic CRM tools).

- Advanced Plan: $34/month per user (workflow automation and email sync).

- Professional Plan: $49/month per user (more advanced reporting and task automation).

- Power Plan: $64/month per user (custom permission settings and expanded features).

- Enterprise Plan: $99/month per user (full feature access with unlimited customization and support).

Small to medium-sized accounting firms focused on managing client acquisition and improving sales processes. Firms that want a simple, easy-to-navigate CRM to manage leads, track deals, and automate client follow-ups will find Pipedrive a strong fit, especially if they are looking for an affordable yet scalable solution.

6. Freshsales

Freshsales CRM is a cloud-based solution by Freshworks, designed to streamline sales processes with AI-based insights, automation, and a user-friendly interface. It offers powerful tools to manage customer relationships and communications efficiently, making it ideal for businesses of all sizes, including accounting firms.

Key Features:

- AI-Powered Lead Scoring: Helps accounting firms prioritize leads based on their engagement level and likelihood to convert, ensuring resources are focused on high-potential clients.

- Contact & Account Management: Centralized platform to store all client information, making it easier for accounting firms to track communication, manage projects, and maintain a comprehensive client view.

- Automation of Workflows: Automates routine tasks such as email follow-ups, invoicing, and task assignments, allowing accountants to focus on more complex client work.

- Built-in Email & Phone System: Enables direct communication with clients via email or phone within the CRM, making it easy for accounting professionals to maintain contact history and manage ongoing conversations.

- Custom Reports & Dashboards: Generate customized reports to track firm performance, client profitability, and service efficiency, providing insights to improve decision-making.

- Integration with Accounting Tools: Seamlessly integrates with accounting platforms like QuickBooks and Xero, streamlining data management for accountants.

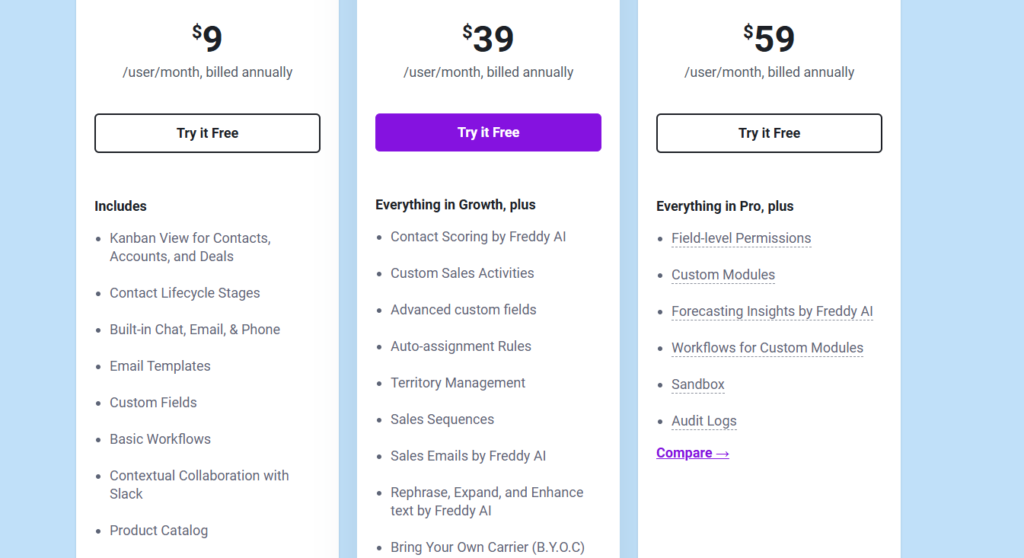

Pricing:

- Free Plan: $0 for unlimited users with essential CRM features.

- Growth Plan: $15/user/month (adds automation, workflows, and more advanced features).

- Pro Plan: $39/user/month (includes AI insights, reports, and advanced customization).

- Enterprise Plan: $69/user/month (full features with advanced permissions and analytics).

Small to medium-sized accounting firms that need an affordable CRM solution with strong automation features. Freshsales is best suited for firms looking to streamline their client communication, lead tracking, and workflow automation, while also benefiting from AI-powered insights for better decision-making.

Which CRM is Best for Your Accounting Firm?

Overall Recommendation

After evaluating the features, pricing, and suitability for accounting firms, Salesforce emerges as the best CRM for accounting firms overall. Its robust feature set, scalability, and extensive customization options make it an ideal choice for firms of all sizes. Salesforce’s comprehensive suite of tools allows accounting firms to manage client relationships effectively, automate workflows, and gain valuable insights through advanced analytics.

Use Case Recommendations

- Small Accounting Firms: HubSpot CRM is an excellent choice for smaller firms looking for a user-friendly and cost-effective solution. Its intuitive interface and free tier make it accessible for firms just starting with CRM systems.

- Medium to Large Firms: Salesforce and Zoho CRM are well-suited for medium to large accounting firms that require advanced features, extensive customization, and integration capabilities.

- Firms Focused on Sales and Lead Management: Pipedrive is ideal for accounting firms that prioritize sales pipeline management and lead tracking. Its visual sales pipeline and automation features streamline the sales process.

- Firms Seeking Budget-Friendly Options: Freshsales offers a comprehensive set of features at competitive pricing, making it a great option for firms looking to balance functionality and cost.

Next Steps

Ready to enhance your accounting firm’s customer relationship management? Start by signing up for a free trial with Salesforce or scheduling a demo to explore how it can transform your business operations. Evaluate your firm’s specific needs, compare features, and take advantage of trial periods to find the perfect CRM solution that aligns with your goals.

How to Choose a CRM: A Beginner’s Buying Guide for Accounting Firms

Selecting the right CRM can seem daunting, especially for those new to customer relationship management systems. Here’s a step-by-step guide to help you navigate the process:

Step 1: Identify Your Business Needs

Begin by assessing your firm’s specific requirements. Consider the following questions:

- What are your primary goals for using a CRM?

- What features are essential for your accounting practice (e.g., contact management, lead tracking, reporting)?

- How many users will need access to the CRM?

Step 2: Evaluate Key Features

Once you’ve identified your needs, evaluate CRM solutions based on their features. Key features to look for include:

- Contact Management: Ability to store and organize client information.

- Lead and Opportunity Management: Tools for tracking potential clients and sales opportunities.

- Automation: Automation of routine tasks such as follow-up emails and appointment scheduling.

- Reporting and Analytics: Insights into client interactions, sales performance, and business metrics.

- Integration: Compatibility with other tools and software your firm uses, such as accounting software and email platforms.

Step 3: Consider Budget Constraints

Determine your budget for a CRM system. While some CRMs offer free tiers, others may require a subscription. Factor in costs for additional features, user licenses, and potential customization. It’s important to choose a CRM that provides the best value within your budget without compromising on essential features.

Step 4: Assess Customer Support

Reliable customer support is crucial, especially during the initial setup and onboarding process. Look for CRM providers that offer comprehensive support options, including live chat, phone support, email assistance, and extensive knowledge bases. Additionally, check for available training resources such as tutorials, webinars, and documentation to help your team get up to speed quickly.

Step 5: Take Advantage of Free Trials and Demos

Before making a final decision, take advantage of free trials or demo versions of the CRM solutions you’re considering. This hands-on experience allows you to evaluate the system’s usability, features, and how well it integrates with your existing workflows. Involve your team in the trial process to gather feedback and ensure the CRM meets everyone’s needs.

Step 6: Make an Informed Decision

After thoroughly evaluating your options, make an informed decision based on how well each CRM aligns with your business needs, budget, and long-term goals. Remember, the right CRM should not only address your current requirements but also support your firm’s growth and evolving needs.

Conclusion

Selecting the best CRM for your accounting firm is a critical decision that can significantly impact your business’s efficiency, client satisfaction, and overall success. By carefully evaluating your needs, considering key features, and assessing your budget, you can choose a CRM system that aligns perfectly with your firm’s goals and workflows.

When choosing a CRM, always consider your long-term business goals and scalability. A CRM that grows with your firm and adapts to your changing needs will provide lasting value and support your continued success. Invest the time to explore your options, leverage free trials, and consult with CRM experts to ensure you make the best choice for your accounting firm.

FAQs

1. Do I really need a CRM?

Absolutely. A CRM system helps you manage client relationships more effectively, streamline operations, and gain valuable insights into your business performance. It’s essential for improving customer satisfaction, increasing sales, and driving business growth.

2. How secure is my data in a CRM?

Data security is a top priority for CRM providers. Reputable CRMs implement robust security measures, including data encryption, regular backups, and compliance with industry standards such as GDPR. Always choose a CRM that prioritizes data security to protect your sensitive client information.

3. Can a CRM integrate with my existing tools?

Most modern CRM systems offer extensive integration capabilities with a wide range of tools and software, including accounting software, email platforms, and marketing tools. Integration ensures seamless data flow and enhances the functionality of your CRM.

4. What is the cost of implementing a CRM system?

The cost of a CRM system varies depending on the provider, features, and the number of users. Some CRMs offer free tiers with basic features, while others have tiered pricing plans based on the level of functionality required. It’s important to evaluate your budget and choose a CRM that offers the best value for your investment.

5. How long does it take to set up a CRM?

The setup time for a CRM system depends on its complexity and the level of customization required. Simple CRM systems can be set up in a few hours, while more comprehensive solutions may take several weeks. Proper planning and utilizing available support resources can help expedite the setup process.

6. Can a CRM help with client retention?

Yes, a CRM system helps improve client retention by enabling you to manage and nurture client relationships more effectively. Features like automated follow-ups, personalized communication, and detailed client profiles ensure that your clients feel valued and engaged.

7. Is training required to use a CRM?

While many CRM systems are designed to be user-friendly, some training is typically required to fully leverage their features. Most CRM providers offer training resources such as tutorials, webinars, and documentation to help your team get up to speed quickly.

8. What are the key benefits of using a CRM for an accounting firm?

Key benefits include improved client relationship management, streamlined operations, enhanced data organization, better communication, increased sales and revenue, and valuable insights through reporting and analytics. A CRM helps accounting firms operate more efficiently and deliver superior client services.

9. Can a CRM help with marketing efforts?

Yes, many CRM systems include marketing automation features that help you manage and track marketing campaigns, segment your audience, and analyze the effectiveness of your marketing efforts. This integration ensures that your marketing strategies are aligned with your sales and client management processes.

10. How do I ensure a smooth transition to a new CRM?

To ensure a smooth transition, plan the migration process carefully, involve your team in the selection and implementation stages, provide adequate training, and utilize the CRM’s support resources. It’s also beneficial to start with a pilot phase to identify and address any potential issues before a full-scale rollout.

I’m Palash Pramanik, an SEO and CRM expert with a deep passion for helping businesses thrive online. I specialize in driving higher search engine rankings and creating seamless customer relationship management strategies to enhance both visibility and engagement. Whether you need to boost your online presence, attract the right audience, or streamline your client interactions, I offer tailored solutions designed to meet your specific needs. My goal is to help you optimize your digital strategy, strengthen customer connections, and drive sustainable growth. Let’s work together to elevate your business to new heights!