Did you know that financial advisors who leverage Customer Relationship Management (CRM) systems report a 29% increase in client retention rates? In an industry where relationships are paramount, a robust CRM isn’t just a luxury—it’s a necessity.

As a CRM expert, my goal in this article is to guide financial advisors through the maze of CRM solutions, comparing the top options to help you identify the Best CRM for Financial Advisors tailored to your unique needs.

Choosing the right CRM is critical for your business’s success. A well-implemented CRM can streamline your operations, enhance client interactions, and ultimately drive growth. Conversely, a subpar system can lead to inefficiencies, lost opportunities, and frustrated clients.

This article will delve into the key features you should look for in a CRM, provide a curated list of the Best CRM for Financial Advisors, and offer actionable recommendations to help you make an informed decision. We’ll explore aspects like pricing, key functionalities, and the best use cases for each CRM solution.

What to Look for in a CRM for Financial Advisors?

Selecting the Best CRM for Financial Advisors involves evaluating several critical factors to ensure the system aligns with your business goals and operational needs.

Financial practices evolve, and your CRM should grow alongside your business. Whether you’re expanding your team, diversifying services, or increasing your client base, the CRM should accommodate your growth without compromising performance.

An intuitive interface and straightforward onboarding process are crucial, especially for small teams. The Best CRM for Financial Advisors should minimize the learning curve, allowing you to focus on client relationships rather than grappling with complex software.

Every financial advisory practice has unique requirements. The CRM you choose should offer customization options to tailor workflows, dashboards, and reporting features to match your specific business processes and client management strategies.

A robust CRM should seamlessly integrate with other essential tools you use, such as email marketing platforms, accounting software, and document management systems. This interoperability ensures a cohesive workflow and eliminates the need for manual data transfers.

Top 5 Best CRMs for Financial Advisors

When it comes to finding the Best CRM for Financial Advisors, several standout options cater specifically to the nuances of financial services. Here are six top contenders:

HubSpot CRM is renowned as one of the Best CRM for Financial Advisors, offering a user-friendly platform tailored to meet the unique needs of financial professionals. Its robust features, seamless integrations, and scalability make it an ideal solution for managing client relationships and driving business growth.

1. HubSpot CRM

HubSpot CRM is a highly popular, user-friendly platform offering tools for marketing, sales, customer service, and content management. It provides a centralized system to track interactions with leads, clients, and prospects, making it ideal for financial advisors who need to manage their relationships effectively. HubSpot’s intuitive design, automation features, and powerful reporting tools make it a go-to solution for businesses of all sizes, from solo financial advisors to large advisory firms.

Key Features:

- Contact Management: Store and track client information for personalized service.

- Email Automation: Schedule emails, automate follow-ups, and save time.

- Lead Scoring: Prioritize high-potential leads based on engagement.

- Pipeline Management: Visual sales tracking to manage prospects efficiently.

- Reporting Dashboards: Analyze sales, client data, and performance.

- Client Communication: Integrate email, calls, and live chat for seamless interaction.

- Integrations: Connect with other financial tools for a streamlined workflow.

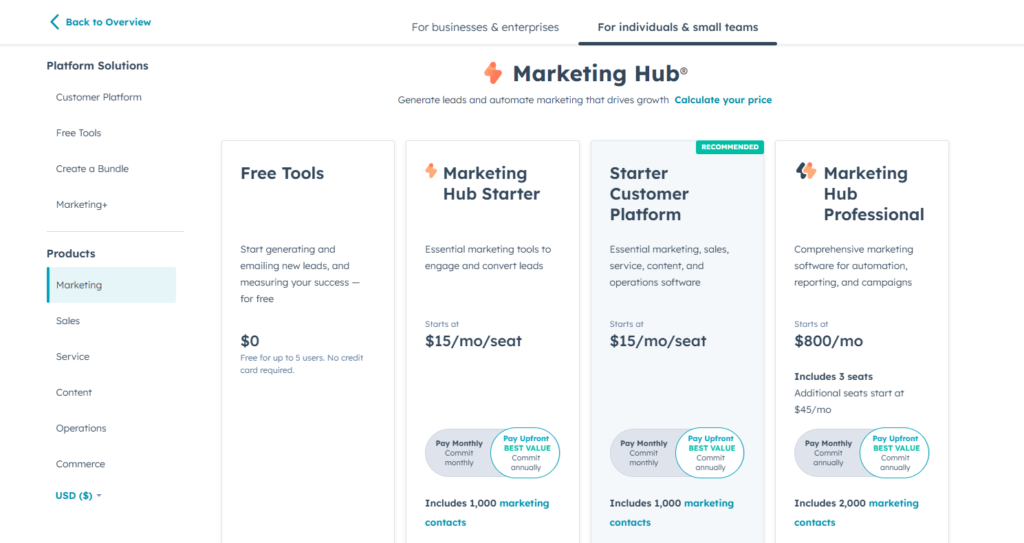

Pricing:

Enterprise: $3,600/month for robust reporting and security features.

Free: Basic CRM features.

Starter: $15/month for basic automation.

Professional: $800/month for advanced marketing tools.

HubSpot CRM is a highly adaptable tool that provides financial advisors with a comprehensive suite of features to streamline client relationship management, improve communication, and enhance business efficiency. It scales from solo advisors using the free version to large firms needing enterprise-level capabilities.

2. Pipedrive CRM

Pipedrive is a sales-focused CRM designed for businesses to manage leads and deals visually. It offers an intuitive interface and strong pipeline management, making it ideal for financial advisors focused on client acquisition and retention.

Key Features:

- Pipeline Management: Visualize and track deals through customizable stages.

- Task Management: Set reminders and track client activities.

- Email Integration: Send and track emails directly from the CRM.

- Reporting: Custom dashboards for performance tracking.

- Automation: Automate repetitive tasks and follow-ups.

- Mobile App: Manage clients and tasks on the go.

- Integrations: Connect with third-party tools for a seamless workflow.

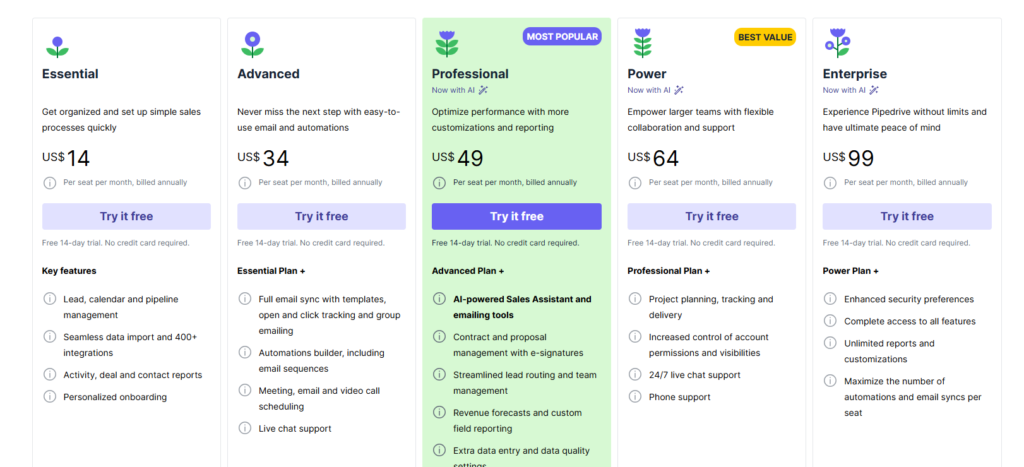

Pricing:

- Essential: $14/month per user

- Advanced: $34/month per user

- Professional: $49/month per user

- Power: $64/month per user

- Enterprise: $99/month per user

Pipedrive is ideal for financial advisors who are sales-oriented and want a CRM that offers strong visual pipeline management, simple task tracking, and automation. Advisors in smaller or medium-sized firms that focus on client acquisition and retention would benefit most from Pipedrive’s intuitive features. It’s particularly suited for advisors who prioritize a streamlined sales process and prefer a CRM that doesn’t overwhelm with unnecessary complexity.

3. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is a CRM designed for financial professionals, offering tools for managing client relationships, tracking financial goals, and automating workflows. It’s built specifically for wealth managers and financial advisors, providing a 360-degree view of clients and their financial needs.

Key Features:

- Client 360 View: Complete view of client profiles, goals, and interactions.

- Goal Tracking: Monitor and manage client financial objectives.

- Automation: Streamline onboarding and communications with automated workflows.

- Analytics: Advanced reporting and AI-powered insights.

- Collaboration: Secure data sharing for teams.

- Compliance Management: Track communication and documents for regulatory adherence.

- Integration: Seamlessly connects with financial planning tools.

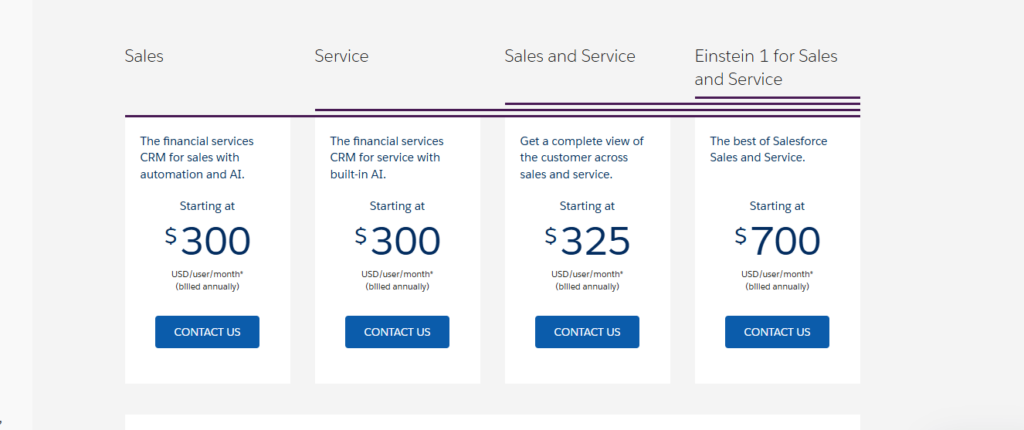

Pricing:

Starts at around $300/user/month, with custom pricing for larger firms and advanced features.

Large financial advisory firms and wealth managers needing comprehensive, customizable CRM solutions with advanced analytics and compliance management.

4. Keap CRM

Keap (formerly Infusionsoft) is a CRM focused on small businesses, offering sales and marketing automation to help manage client relationships and streamline workflows. It is known for its ease of use, automation capabilities, and email marketing features, making it a good option for financial advisors who want to automate client engagement and lead management.

Key Features:

- Automated Email Marketing: Create automated email campaigns to nurture leads and stay connected with clients.

- Lead Management: Capture, organize, and track leads to follow up effectively.

- Appointment Scheduling: Integrated calendar tool for easy client appointment booking.

- Task Automation: Automate repetitive tasks such as follow-ups and client onboarding.

- Customizable Dashboards: Track sales, client activity, and performance metrics.

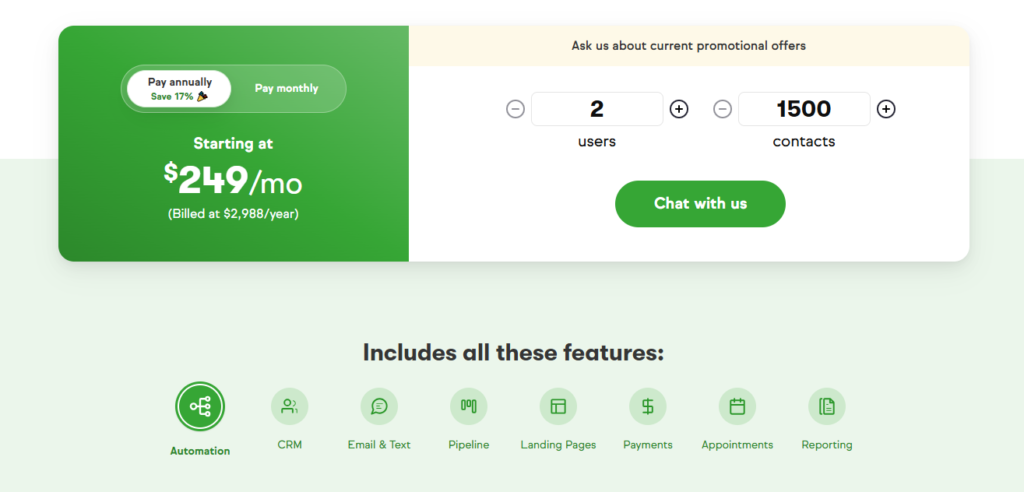

Pricing:

$249/month for 1,500 contacts and 2 users.

Keap is ideal for solo or small financial advisory firms that need strong automation tools for email marketing, lead management, and task automation to save time and grow their business.

5. Redtail CRM

Redtail CRM is specifically designed for financial advisors, offering a range of tools to manage client relationships, streamline operations, and ensure compliance. It is known for its ease of use, robust integrations, and focus on financial professionals.

Key Features:

- Client Management: Centralized client data, history, and notes for personalized service.

- Task & Workflow Automation: Automate client follow-ups and task reminders.

- Compliance Tracking: Built-in tools to track and report communications for regulatory compliance.

- Document Management: Securely store and manage client files.

- Integrations: Seamless integrations with portfolio management, financial planning, and risk analysis tools.

Pricing:

$99/month for up to 15 users.

Redtail is best for small to mid-sized financial advisory firms that prioritize client management, compliance, and integrations with other financial tools.

Which CRM is Best for Your Financial Advisory Practice?

After evaluating the options, Hubspot emerges as the Best CRM for Financial Advisors due to its comprehensive feature set, scalability, and robust integration capabilities. Its tailored solutions for financial services make it a top choice for firms aiming for growth and efficiency.

- E-commerce Financial Advisors: HubSpot CRM offers excellent marketing automation features, making it ideal for advisors who blend financial services with online retail strategies.

- Service-Based Financial Advisors: Redtail CRM is perfect for those focusing on client service and relationship management, offering specialized tools for financial professionals.

- Startups and Small Firms: Wealth box provides an intuitive interface and affordable pricing, making it suitable for newer or smaller advisory practices seeking essential CRM functionalities without the complexity.

Ready to enhance your financial advisory practice? Start by signing up for a free trial of the CRM that best fits your needs. Experience firsthand how the CRM for Financial Advisors can transform your client management and business operations.

Conclusion

Choosing the Best CRM for Financial Advisors is a pivotal decision that can significantly impact your business’s efficiency, client satisfaction, and growth trajectory. A well-suited CRM system streamlines your workflows, enhances client interactions, and provides valuable insights to drive informed decision-making.

When selecting a CRM, consider not just your current needs but also your long-term business objectives. The right CRM should be a partner in your growth journey, offering flexibility, robust features, and seamless integrations to support your evolving practice.

FAQs

Do I really need a CRM?

Absolutely. A CRM system centralizes client information, streamlines communication, and automates routine tasks, allowing you to focus more on client relationships and less on administrative work. For financial advisors, this means better client service, increased efficiency, and the ability to scale your practice effectively.

How secure is my data in a CRM?

Top-tier CRMs prioritize data security with features like encryption, secure data centers, and regular security audits. It’s crucial to choose a CRM that complies with industry standards and regulations, such as GDPR and FINRA, to ensure your clients’ sensitive financial information is protected.

Can a CRM integrate with my existing tools?

Yes, most of the Best CRM for Financial Advisors offer extensive integration capabilities. Whether you use email marketing platforms, accounting software, or document management systems, a compatible CRM will seamlessly connect with your existing tools, creating a unified and efficient workflow.

What is the cost of implementing a CRM?

The cost varies depending on the CRM you choose and the specific features you need. Many CRMs offer tiered pricing plans to accommodate different business sizes and budgets. It’s essential to evaluate the pricing structure in relation to the value and functionalities provided to ensure it aligns with your financial advisory practice’s needs.

How long does it take to implement a CRM?

Implementation time can range from a few days to several weeks, depending on the complexity of the CRM and the size of your team. Selecting a user-friendly CRM with robust support and training resources can significantly reduce the onboarding time, allowing you to start reaping the benefits sooner.

I’m Rejaul Karim, an SEO and CRM expert with a passion for helping small businesses grow online. I specialize in boosting search engine rankings and streamlining customer relationship management to make your business run smoothly. Whether it's improving your online visibility or finding better ways to connect with your clients, I'm here to provide simple, effective solutions tailored to your needs. Let's take your business to the next level!