Did you know that businesses using a CRM system experience a 29% increase in sales? This statistic highlights the critical role of Customer Relationship Management (CRM) in modern businesses, particularly in sectors such as insurance, where maintaining strong client relationships is vital for success.

In this article, we aim to compare the best CRM solutions specifically tailored for insurance brokers. We will explore the unique needs of the insurance industry and how the right CRM can help brokers streamline their operations and enhance client relationships.

Selecting the right CRM is pivotal for achieving business success. An effective CRM system can improve customer retention, increase sales, and streamline operations, allowing insurance brokers to focus on what matters most: building relationships with clients and growing their business.

This comprehensive guide will cover key features, pricing structures, and ideal use cases for various CRM solutions. We will also provide a step-by-step guide to help you choose the best CRM for your insurance brokerage.

What to Look for in a CRM for Your Business

Scalability:

One of the most critical factors to consider when choosing a CRM for your insurance brokerage is scalability. As your business grows, your CRM should be able to accommodate increasing data, user demands, and new features without compromising performance. Look for solutions that offer flexible plans and can expand as your needs change.

Ease of Use:

An intuitive interface is essential for a smooth onboarding process, especially for small teams or those new to CRM systems. A user-friendly CRM can significantly reduce the learning curve, allowing your team to start benefiting from the system almost immediately.

Customization:

Every insurance brokerage has unique workflows and requirements. Therefore, a CRM with customizable features is vital. The ability to tailor the CRM to fit your specific processes will enhance efficiency and user adoption.

6 Best CRM Solutions for Insurance Brokers

1. HubSpot CRM

HubSpot CRM is an all-in-one platform designed to help businesses manage marketing, sales, and customer service tasks. It offers a user-friendly interface with strong automation features, making it suitable for both small businesses and large enterprises.

Key Features:

- Lead Management: Track, segment, and nurture leads through a simple pipeline interface.

- Email Tracking & Templates: Automate emails and track their performance to optimize follow-ups.

- Sales Pipeline Management: Visualize and organize deals across the sales funnel, enabling better tracking of progress and goals.

- Live Chat and Chatbots: Offer real-time customer service and automate responses through AI-powered bots.

- Marketing Hub Integration: Allows for seamless inbound marketing, including blog management, social media, and SEO tools.

- Reporting & Analytics: In-depth insights into sales performance and customer behavior.

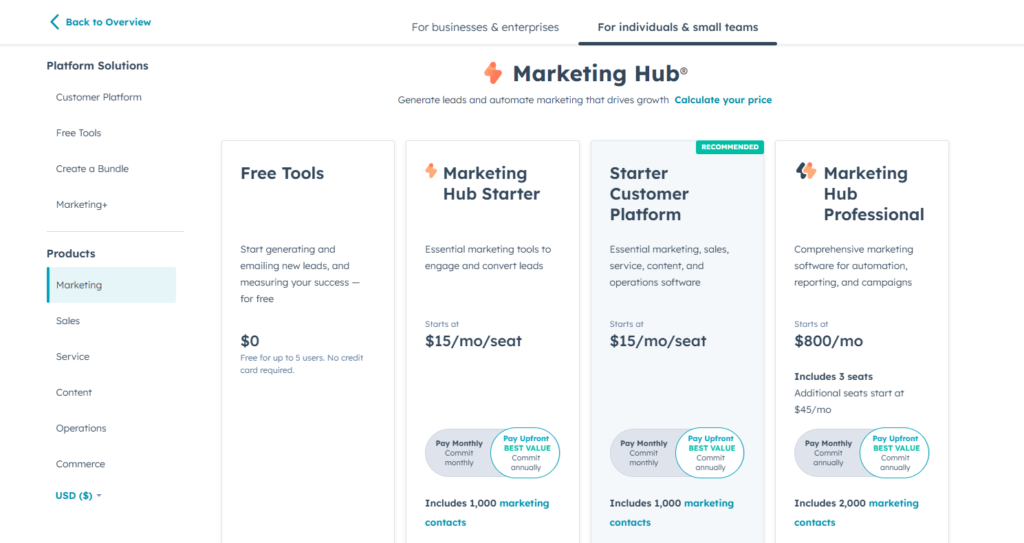

Pricing:

- Free Plan: $0 (Includes core CRM features such as contact management, email tracking, and basic reporting).

- Starter: $15/month (For more advanced tools like simple automation, email templates, and calling).

- Professional: $800/month (Includes marketing automation, advanced reporting, and sales automation).

- Enterprise: $3,600/month (Enhanced customization, predictive lead scoring, and enterprise-level support).

Insurance Brokers who want an easy-to-use platform with excellent customer engagement tools, lead tracking, and email marketing integration. It’s especially great for small- to medium-sized agencies looking for an affordable yet scalable solution. The free version offers great value for brokers starting out, while larger firms can benefit from the advanced sales and marketing tools available in higher tiers.

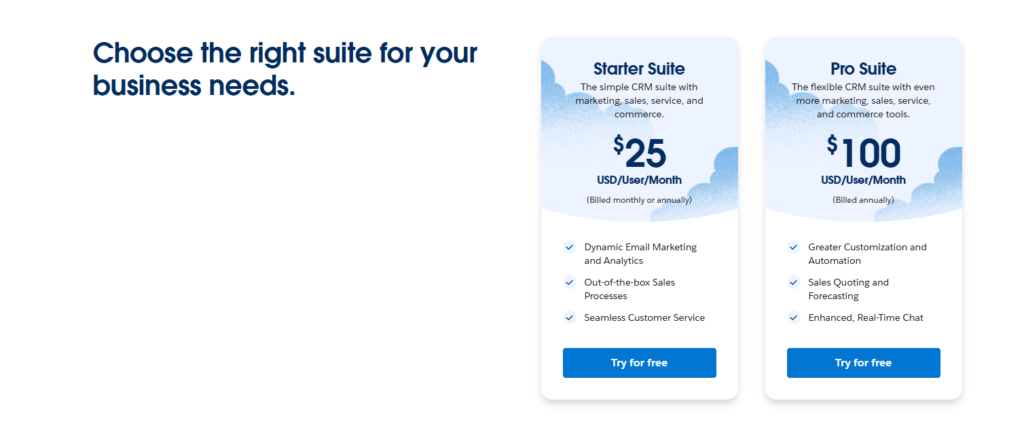

2. Salesforce CRM

Salesforce is one of the most widely used and powerful CRM platforms globally, offering extensive customization, scalability, and automation tools. It is known for its flexibility, allowing businesses of all sizes to manage customer relationships, sales processes, and marketing efforts in a centralized platform.

Key Features:

- Lead and Opportunity Management: Track leads and opportunities throughout the entire sales cycle, making it easier to convert prospects into clients.

- Customizable Dashboards and Reports: Deep insights into customer data, providing comprehensive reporting to track performance metrics.

- Automation Tools: Automate routine tasks, such as email follow-ups, task assignments, and data entry, saving brokers time.

- Sales Cloud and Service Cloud: Specialized tools to manage sales pipelines and customer service interactions.

- AppExchange Marketplace: Access to thousands of third-party apps for industry-specific customization, including insurance-focused tools.

- AI-Powered Einstein Analytics: Leverage AI to predict customer behavior and enhance decision-making processes.

Insurance Brokers with larger teams or those who need robust customization and advanced reporting. Salesforce is perfect for insurance agencies that deal with large volumes of clients and require detailed tracking and automation. The extensive third-party integrations also make it ideal for brokers looking to scale and integrate industry-specific tools.

3. Zoho CRM

Zoho CRM is a versatile and affordable platform that offers businesses a range of tools to manage sales, marketing, and customer support. It’s known for its ease of use and affordability, especially for small to mid-sized businesses. Zoho also integrates seamlessly with other Zoho apps, providing a comprehensive business management solution.

Key Features:

- Lead and Contact Management: Easily manage leads, contacts, and client interactions in one place, making it easy for brokers to stay organized.

- Sales Automation: Automates repetitive tasks like lead assignment, follow-ups, and data entry, improving efficiency for insurance brokers.

- Customizable Workflows: Allows brokers to create custom processes for claims, policy renewals, and client management.

- AI-Powered Zia Assistant: Provides insights, predicts future customer behavior, and recommends next best actions for brokers.

- Email Integration and Automation: Send targeted emails, track their performance, and automate follow-up sequences.

- Multi-Channel Communication: Engage with clients via email, social media, phone, and live chat from a single interface.

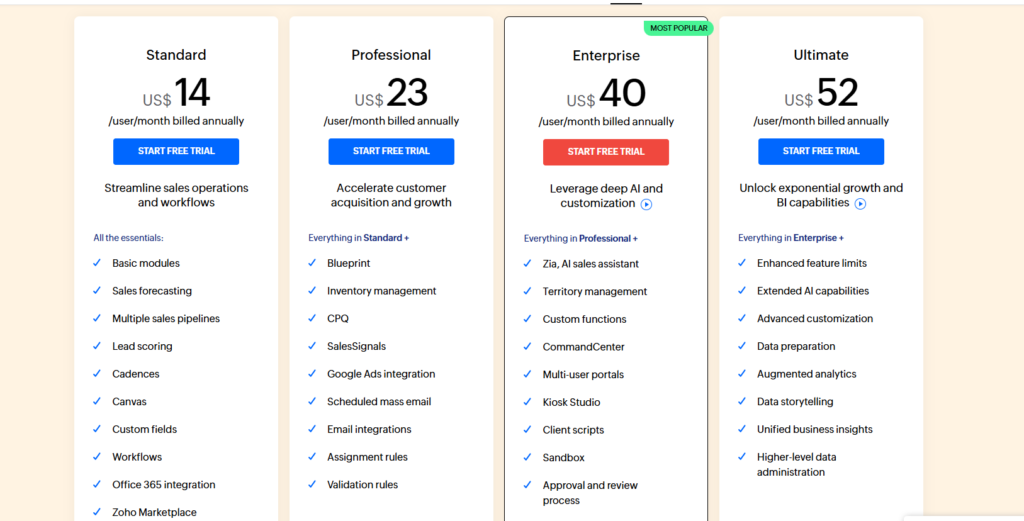

Pricing:

- Free Edition: $0 (For up to 3 users, with basic CRM features).

- Standard: $14/user/month (Basic automation, email insights, and reporting).

- Professional: $23/user/month (Includes workflows, process management, and inventory management).

- Enterprise: $40/user/month (Advanced customization, AI insights, and multi-channel capabilities).

- Ultimate: $52/user/month (Enhanced AI features, advanced analytics, and premium support).

Insurance Brokers who need an affordable, easy-to-use CRM with strong automation and multi-channel communication. It’s particularly suitable for small and medium-sized insurance agencies looking to streamline their operations and customer management without breaking the bank. The AI features and customizable workflows are also great for scaling operations as the business grows.

4. Pipedrive CRM

Pipedrive is a sales-focused CRM that is designed to simplify pipeline management and automate sales processes. It offers an intuitive and visual interface that makes it easy to track deals, leads, and sales activities, which is particularly useful for brokers in fast-paced environments.

Key Features:

- Visual Sales Pipeline: A drag-and-drop interface that helps brokers visualize their sales process and manage leads through each stage.

- Lead and Deal Management: Organizes and tracks leads efficiently, ensuring brokers stay on top of follow-ups and potential clients.

- Customizable Pipelines: Tailored for insurance brokers to create custom stages like policy renewals, claims management, or lead nurturing.

- Email Integration & Automation: Syncs with email to manage communication and automate repetitive tasks like follow-up reminders.

- Activity Tracking: Logs calls, emails, and meetings to provide a clear history of customer interactions.

- Reporting and Insights: Offers customizable reports to track sales performance, helping brokers optimize their sales strategy.

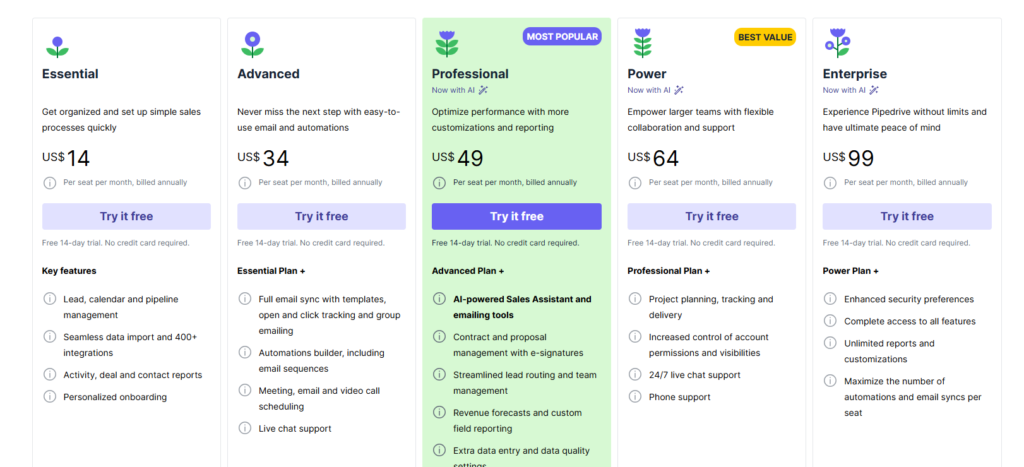

Pricing:

- Essential Plan: $14/month per user (Basic pipeline management and automation tools).

- Advanced Plan: $34/month per user (Advanced email syncing, automation workflows, and insights).

- Professional Plan: $49/month per user (Enhanced customization, team collaboration tools, and reporting).

- Power Plan: $64/month per user (Full automation capabilities and sales forecasting).

- Enterprise Plan: $99/month per user (Unlimited features, customizations, and priority support).

Insurance Brokers who prioritize deal management and need a simple, visual tool to track leads and clients. Pipedrive is especially useful for small- to medium-sized agencies that focus heavily on sales and deal tracking. Its ease of use and automation features make it a great fit for brokers who want a streamlined approach to managing their pipeline.

5. Keap CRM

Keap (formerly Infusionsoft) is a CRM designed for small businesses and entrepreneurs, offering a combination of sales and marketing automation. It is particularly focused on helping businesses streamline customer interactions, automate marketing efforts, and close more deals.

Key Features:

- Automated Follow-Up: Automatically sends follow-up emails or messages to clients, ensuring that brokers maintain contact without manual effort.

- Sales Pipeline Management: Allows brokers to track leads, manage sales stages, and follow up with potential clients effectively.

- Email Marketing Automation: Automates email campaigns, making it easier for brokers to stay in touch with clients through targeted marketing messages.

- Appointment Scheduling: Integrates with calendar apps to streamline booking meetings and consultations, a critical feature for insurance brokers managing multiple client relationships.

- Invoicing & Payments: Handles invoicing and payments directly through the CRM, helping brokers manage policy renewals and payments in one system.

- Contact Management: Provides a centralized place for storing client details, tracking interactions, and setting reminders for policy renewals or follow-ups.

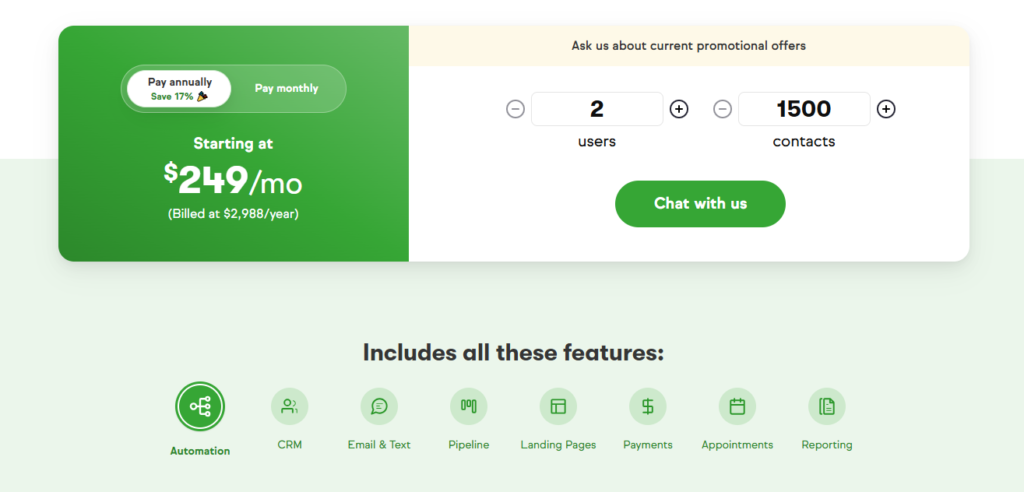

Pricing:

- Keap Pro: $249/month for 1,500 contacts and 2 users (Additional fees for more contacts or users).

Insurance Brokers who need robust marketing automation combined with sales pipeline management. It’s ideal for brokers who focus on nurturing long-term client relationships through automated follow-ups and email marketing. Keap is particularly useful for smaller agencies or independent brokers that want an all-in-one solution for managing client communication, sales, and invoicing.

6. Nimble CRM

Nimble CRM is a simple yet powerful relationship management tool designed to help small businesses build and maintain strong customer relationships. It integrates seamlessly with email, social media, and other business apps to provide a unified view of client interactions, making it ideal for brokers who value personal client engagement.

Key Features:

- Unified Contact Management: Combines data from various platforms (email, social media, calendar) into a single, comprehensive client profile, helping brokers stay organized.

- Social Media Integration: Automatically pulls information from social media platforms like LinkedIn and Twitter to keep brokers updated on client activities and interests.

- Pipeline Management: Allows brokers to manage deals, track sales activities, and stay on top of their pipeline for better deal conversion.

- Email Tracking and Group Messaging: Helps brokers send personalized emails at scale, while tracking open rates and engagement for better follow-up strategies.

- Task and Activity Tracking: Ensures brokers never miss important tasks like policy renewals or follow-up meetings.

- Customizable Dashboards and Reporting: Provides insights into sales performance and client engagement, allowing brokers to optimize their approach.

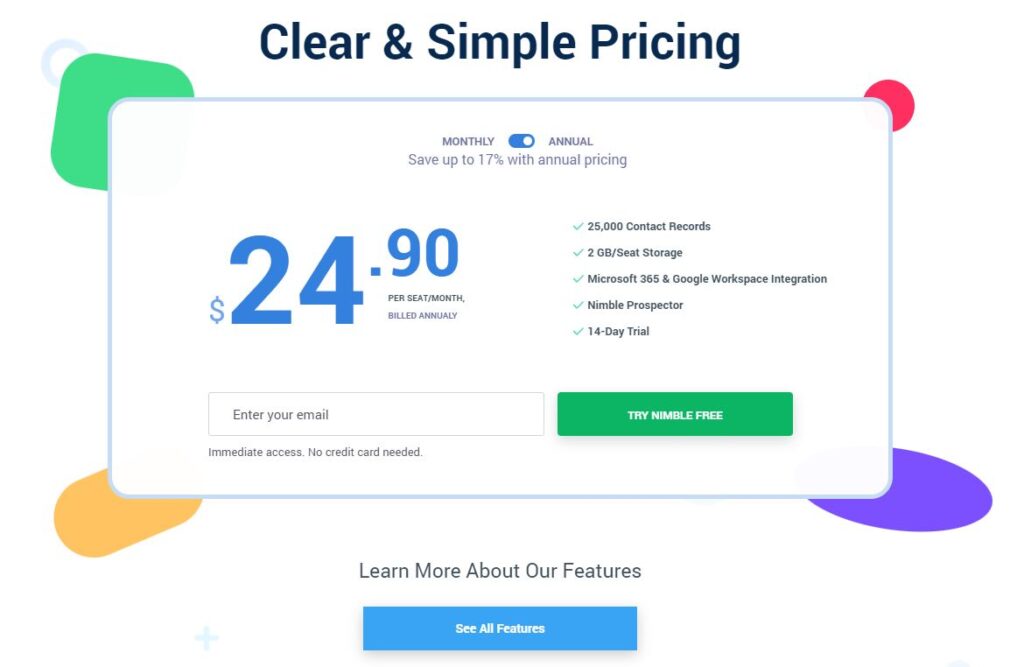

Pricing:

- Nimble Business Plan: $24.90/user/month (Includes full CRM functionality, contact management, deal tracking, and integrations with Microsoft 365 and Google Workspace).

Insurance Brokers who are highly focused on building personal relationships with clients and maintaining strong follow-up strategies. It’s ideal for small to medium-sized brokerages that need a simple yet effective way to manage contacts and track deals, especially those who rely on social media for prospecting and client engagement.

Which CRM is Best for Your Insurance Brokerage?

After careful consideration of the factors mentioned above, Salesforce emerges as the best CRM for insurance brokers. Its robust feature set, scalability, and extensive customization options make it a top choice for businesses looking to enhance their customer relationships and streamline operations.

Use Case Recommendations:

- Salesforce: Ideal for large brokerages with complex needs.

- HubSpot CRM: Best for small to mid-sized brokerages looking for an easy-to-use, cost-effective solution.

- Zoho CRM: Great for teams seeking a balance between features and affordability.

- Nimble: Excellent for brokers who want to leverage social media for relationship building.

- Pipedrive: Best for teams focused on sales pipeline management and performance tracking.

If you’re ready to improve your brokerage’s efficiency and client relationships, consider starting a free trial or scheduling a demo with one of the recommended CRM providers. This will allow you to assess their features and see how they align with your business needs.

How to Choose a CRM: A Beginner’s Buying Guide for Insurance Brokers

Step-by-Step Guidance:

- Identify Business Needs: Evaluate the specific challenges your brokerage faces and determine the functionalities you require in a CRM.

- Evaluate Features: Look for essential features like contact management, lead tracking, reporting capabilities, and integration with other tools.

- Consider Budget Constraints: Determine your budget for CRM solutions and look for options that offer the best value for your investment.

- Assess Customer Support: Research the level of customer support offered by the CRM providers, including training resources and helpdesk availability.

Conclusion

In summary, selecting the right CRM is crucial for insurance brokers aiming to enhance customer relationships and streamline operations. With various options available, it’s essential to evaluate each based on scalability, ease of use, and customization capabilities.

As you choose a CRM, consider your long-term business goals and ensure that the solution can grow with you. The right CRM will not only facilitate day-to-day operations but also empower your brokerage to thrive in a competitive landscape.

Explore the CRM options mentioned in this article by clicking on the links to start your journey toward optimizing your customer relationship management strategy.

FAQs

- Do I really need a CRM?

Yes, a CRM is crucial for managing customer relationships effectively, improving communication, and streamlining processes. - How secure is my data in a CRM?

Most reputable CRM systems implement robust security measures, including data encryption, regular backups, and compliance with data protection regulations. - Can a CRM integrate with my existing tools?

Many CRMs offer integration capabilities with popular tools such as email marketing platforms, project management software, and accounting systems. - What is the cost of implementing a CRM system?

The cost can vary widely depending on the provider and features, ranging from free options to several hundred dollars per month for advanced systems. - How long does it take to set up a CRM?

The setup time can vary based on the complexity of your requirements but typically ranges from a few days to several weeks. Many providers offer onboarding support to expedite the process.

A seasoned professional specializing in CRM, SEO, and Social Media Marketing (SMM). With a deep understanding of customer relationship management, I help businesses optimize their digital strategies to enhance customer engagement and drive growth. Passionate about delivering measurable results through data-driven techniques and effective marketing solutions.

Let me know if you’d like any adjustments!