Did you know that businesses leveraging a CRM system can see up to a 29% increase in sales? In today’s competitive market, especially for life insurance agents, managing client relationships effectively is crucial. This article aims to guide you through the top CRM solutions tailored for life insurance professionals. Selecting the right CRM can be the difference between a thriving business and one that struggles to keep up.

We’ll explore key features, pricing structures, and ideal use cases for each CRM solution. Whether you’re a solo agent or part of a larger firm, finding the best CRM for life insurance agents can streamline your operations and enhance customer satisfaction.

What to Look for in a CRM for Your Business?

Scalability

As your client base grows, your CRM should be able to grow with you. Scalability ensures that the system can handle increasing data and user demands without compromising performance. For life insurance agents, this means effortlessly managing more policies, clients, and interactions over time.

Ease of Use

An intuitive interface is essential, especially if you’re new to CRM systems. A straightforward onboarding process can save time and reduce frustration. Life insurance agents often juggle multiple tasks, so a user-friendly CRM allows you to focus on what you do best—serving your clients.

Customization

Every business has unique workflows and requirements. A CRM that offers customizable features lets you tailor the system to fit your specific needs. For life insurance agents, this could mean custom policy tracking, personalized communication templates, or bespoke reporting tools.

5 Best CRM Solutions for Life Insurance Agents

1. HubSpot CRM

HubSpot is a popular all-in-one CRM platform designed to help businesses manage customer relationships, sales, marketing, and customer service. It’s known for its ease of use and robust free plan. For life insurance agents, HubSpot helps automate workflows, track leads, and manage client communications efficiently.

Key Features:

- Contact Management: Centralized database for tracking leads, policyholders, and clients.

- Email Tracking & Templates: Helps agents send follow-up emails with customizable templates and tracks interactions.

- Pipeline Management: Offers visual pipelines for tracking the sales process from lead to policy issuance.

- Marketing Automation: Automated email sequences and lead nurturing campaigns to keep clients engaged.

- Reporting Dashboards: Real-time analytics for performance tracking, helping agents make data-driven decisions.

- Meeting Scheduler: Integrated meeting scheduling for efficient client consultations.

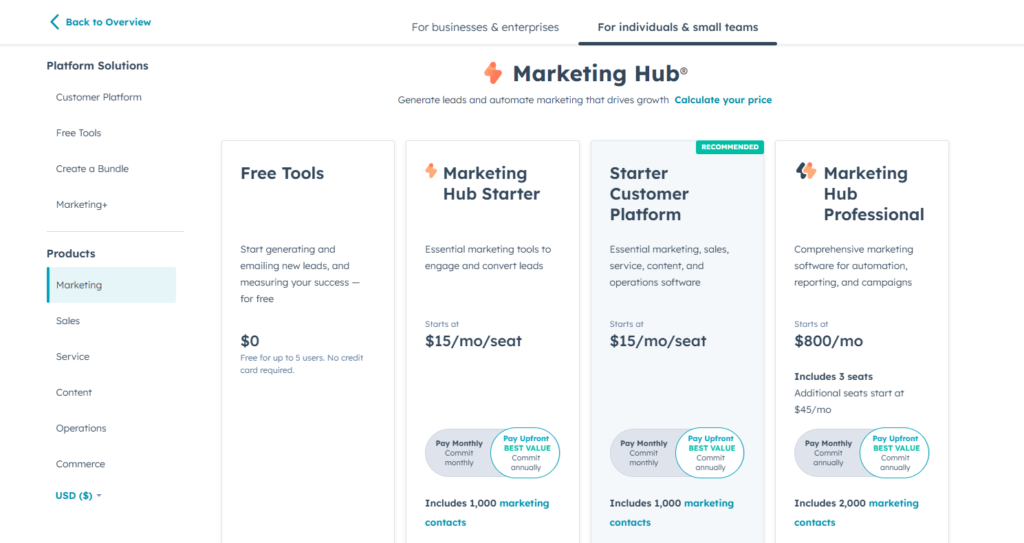

Pricing:

- Free Plan: $0 for core CRM features (contact management, pipelines, email tracking).

- Starter: $15/month (adds more automation and integrations).

- Professional: $800/month (advanced reporting, automation, and workflows).

- Enterprise: $3,600/month (for large teams, includes custom reporting, permissions, and advanced features).

HubSpot is ideal for life insurance agents and small-to-medium agencies looking for a free or cost-effective CRM solution that scales with their business needs, offering advanced automation and sales tracking as they grow. It’s particularly suited for those who want an all-in-one tool with strong email marketing and sales features.

2. Zoho CRM

Zoho CRM is a comprehensive cloud-based CRM solution designed for small to large businesses. It offers a wide range of customizable features and integrates well with other Zoho products. For life insurance agents, it helps streamline client management, automate workflows, and enhance sales efficiency.

Key Features:

- Contact & Lead Management: Helps track client interactions, policy status, and leads in a centralized platform.

- Automation & Workflow Management: Automates tasks like follow-ups, lead assignments, and email campaigns, saving agents time.

- AI-Powered Sales Assistant (Zia): Offers predictive insights, lead scoring, and smart suggestions for better decision-making.

- Customizable Dashboards & Reports: Detailed analytics for tracking sales performance, customer behavior, and agent activities.

- Omnichannel Communication: Integrates calls, emails, social media, and live chat into one platform for seamless communication with clients.

- Mobile CRM: Agents can access client information, update records, and track leads on the go.

Pricing:

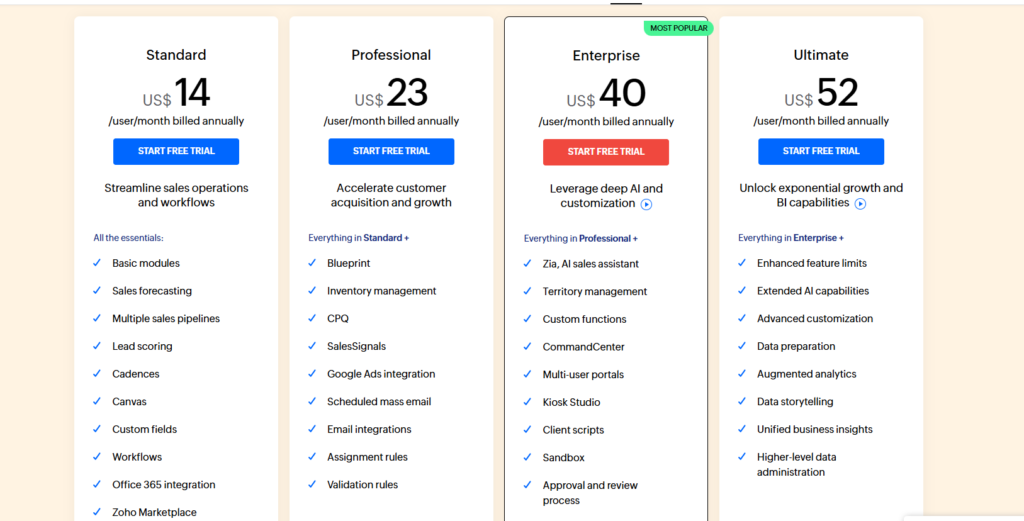

- Free Plan: Free for up to 3 users (limited features).

- Standard: $14/user/month (includes lead management and custom reports).

- Professional: $23/user/month (adds automation and advanced CRM features).

- Enterprise: $40/user/month (AI features, advanced customization, and analytics).

- Ultimate: $52/user/month (full suite of CRM features with enhanced support).

Zoho CRM is well-suited for life insurance agents and agencies of all sizes that need a highly customizable CRM. It’s ideal for agents who handle a large number of clients and require automation for follow-ups, lead tracking, and communication across multiple channels. Its affordability and scalability make it a strong option for growing teams.

3. Salesforce CRM

Salesforce is one of the most powerful and widely used CRMs, known for its scalability and advanced features. It offers robust tools for sales, marketing, customer service, and analytics. For life insurance agents, Salesforce helps manage complex client relationships, track leads, and automate sales processes efficiently.

Key Features:

- Lead & Opportunity Management: Tracks leads through every stage of the sales cycle, from prospecting to closing, ensuring no opportunity is missed.

- Customizable Dashboards & Reports: Advanced reporting tools for tracking sales performance, customer behavior, and campaign effectiveness.

- Sales Automation: Automates follow-ups, client reminders, and document management, allowing agents to focus more on closing deals.

- AI-Powered Insights (Einstein AI): Provides predictive analytics and lead scoring to help agents prioritize high-value prospects.

- Integrations: Integrates with various third-party tools (e.g., marketing, finance) to provide a unified experience.

- Mobile App: Allows agents to access client data, update records, and track progress from anywhere.

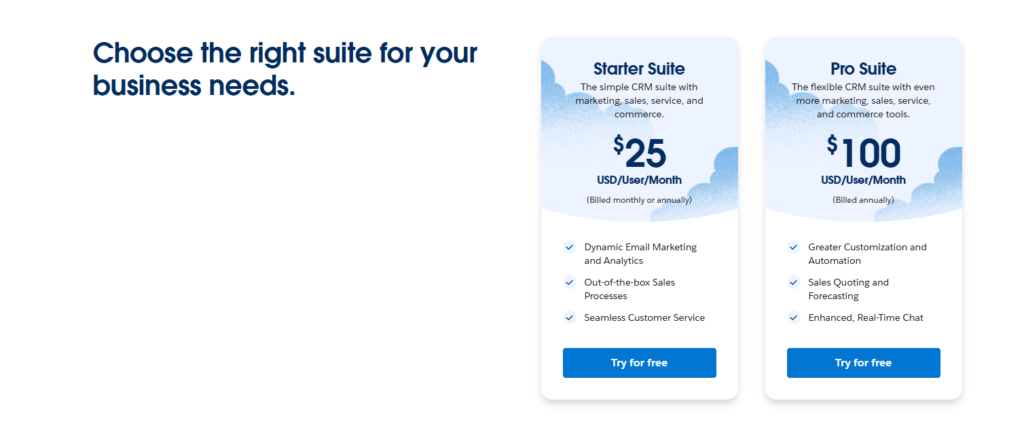

Pricing:

- Essentials: $25/user/month (basic CRM for small teams).

- Professional: $75/user/month (complete CRM with full customization options).

- Enterprise: $150/user/month (advanced automation and enterprise-level customization).

- Unlimited: $300/user/month (unlimited support, customization, and advanced analytics).

Salesforce is ideal for large life insurance agencies or agents handling complex and high-volume client portfolios. It’s best for those who require deep customization, advanced automation, and powerful analytics to scale their operations and manage large teams efficiently. Smaller agencies might find it overwhelming due to its complexity and cost but can benefit from the Essentials plan.

4. Pipedrive CRM

Pipedrive is a user-friendly, sales-focused CRM designed to help small to medium-sized businesses streamline their sales processes. It is particularly well-known for its intuitive pipeline management and easy-to-use interface. For life insurance agents, Pipedrive helps in tracking leads, managing client follow-ups, and optimizing the sales process.

Key Features:

- Visual Sales Pipeline: Helps agents track each deal’s progress, from initial contact to policy sale, with a clear visual layout.

- Activity Reminders: Keeps agents on top of tasks like client follow-ups, policy renewals, and meetings with automated reminders.

- Lead & Deal Tracking: Ensures that agents don’t miss any opportunity by tracking all prospects and deals in a single dashboard.

- Customizable Fields & Pipelines: Allows agents to tailor the CRM to their specific sales processes, offering flexibility in managing various insurance products.

- Email Integration & Tracking: Syncs with email, making it easy to track communications and follow up with clients.

- Reporting & Analytics: Offers detailed insights into sales performance and deal progress, helping agents focus on high-value opportunities.

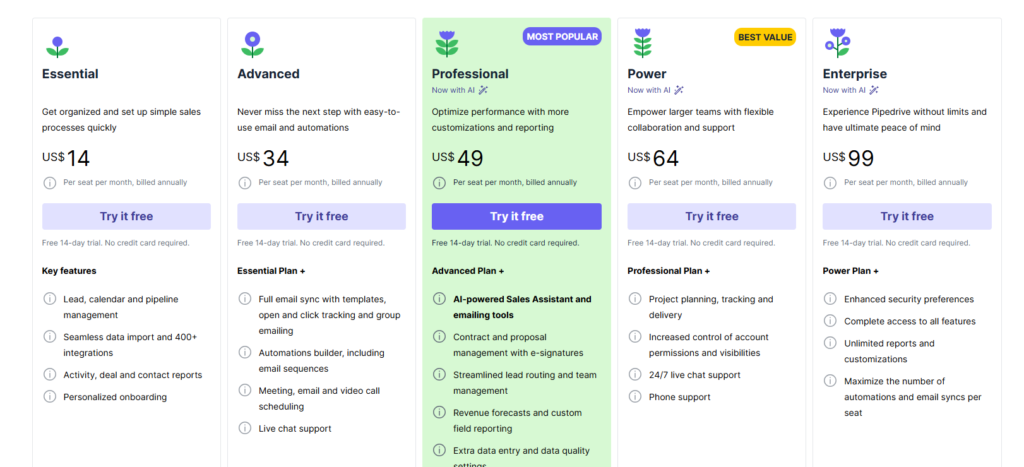

Pricing:

- Essential Plan: $14/month per user.

- Advanced Plan: $34/month per user.

- Professional Plan: $49/month per user.

- Power Plan: $64/month per user.

- Enterprise Plan: $99/month per user.

Pipedrive is best for independent life insurance agents or small-to-medium-sized agencies looking for an affordable and easy-to-use CRM. It’s ideal for those who need a strong focus on pipeline management, deal tracking, and activity reminders without the complexity of larger CRMs. It’s especially useful for agents who prioritize lead management and need to simplify their sales process.

5. Keap CRM

Keap (formerly Infusionsoft) is a CRM platform designed for small businesses, offering a mix of sales automation, email marketing, and client management features. For life insurance agents, Keap helps streamline client communication, automate follow-ups, and manage sales processes, making it easier to nurture and convert leads.

Key Features:

- Client Management: Organizes client data, tracks interactions, and helps agents manage policyholders in one place.

- Automated Follow-Ups: Sends automatic emails and reminders to ensure agents stay on top of leads and follow-up activities.

- Email Marketing: Creates and sends personalized email campaigns to prospects, helping agents nurture leads and maintain client relationships.

- Appointment Scheduling: Integrated calendar and scheduling tool, allowing clients to book consultations directly, reducing scheduling friction.

- Pipeline Management: Visual sales pipelines to track leads and clients through each step of the sales journey, from initial contact to policy issuance.

- Invoicing & Payment Integration: For agents handling payments directly, Keap offers integrated invoicing and payment processing.

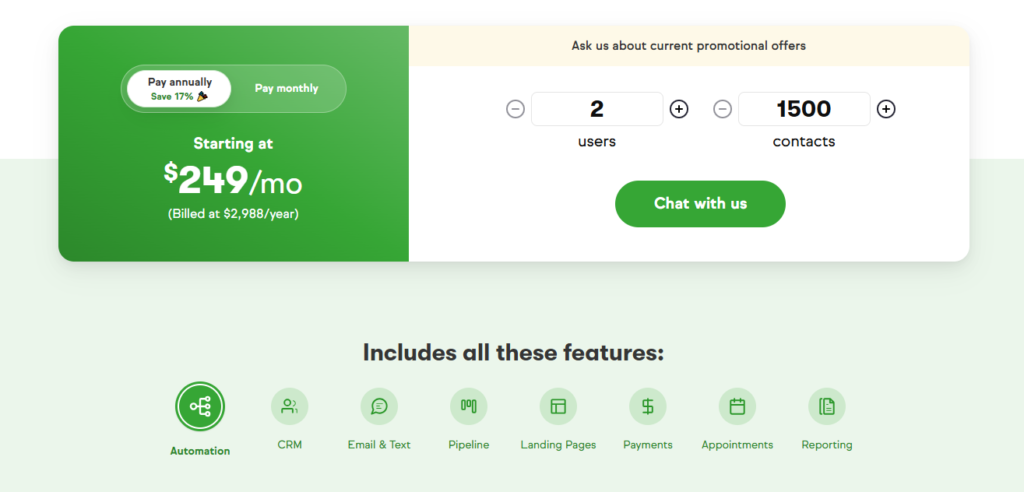

Pricing:

- Pricing: $249/month for 1,500 contacts and 2 users. Custom pricing is available for higher contact numbers and additional users.

Keap is ideal for solo life insurance agents or small agencies that focus on automating client communication, lead nurturing, and follow-ups. It’s especially suited for agents who want a CRM with integrated marketing and appointment scheduling tools, helping them manage relationships and streamline sales activities.

Which CRM is Best for Your Life Insurance Business?

After evaluating the critical factors—scalability, ease of use, and customization—HubSpot CRM stands out as the top choice for life insurance agents. Designed specifically for the insurance industry, it offers tailored features that address the unique challenges faced by agents.

Use Case Recommendations

- Best for Solo Agents: Keap CRM—ideal for individual agents needing comprehensive marketing tools.

- Best for Small Agencies: Pipedrive CRM—offers scalability and industry-specific features.

- Best for Large Firms: Salesforce Financial Services Cloud—provides extensive customization and integration capabilities.

Next Steps

Consider what features are most important for your business. Many of these CRMs offer free trials or demos. Exploring these options can provide firsthand experience to help you choose the best CRM for life insurance agents like yourself.

How to Choose a CRM: A Beginner’s Buying Guide for Life Insurance Agents

- Identify Your Business Needs

- Determine the specific challenges you face in managing client relationships.

- Prioritize features like policy management, client communication, and reporting.

- Evaluate Features

- Look for CRMs that offer insurance-specific tools.

- Assess the scalability to ensure the CRM can grow with your business.

- Consider Budget Constraints

- Compare pricing structures.

- Be mindful of additional costs for add-ons or extra users.

- Assess Customer Support

- Reliable support can make a significant difference.

- Check for resources like tutorials, customer service availability, and training options.

- Test the CRM

- Utilize free trials or demos.

- Engage with the software to gauge its user-friendliness and suitability.

Conclusion

Selecting the right CRM is a pivotal step in enhancing your life insurance business. We’ve discussed the top options and what to consider when making your choice. Remember, the best CRM for life insurance agents is one that aligns with your specific needs and long-term goals.

Think about where you see your business in the next few years. Choose a CRM that not only meets your current requirements but also has the capacity to support future growth. Scalability and customization are key factors that will contribute to sustained success.

FAQs

1. Do I really need a CRM?

Absolutely. A CRM helps you manage client information, track interactions, and streamline processes, which is essential for providing excellent service and staying competitive.

2. How secure is my data in a CRM?

Most reputable CRMs offer robust security measures, including data encryption and regular backups. Always check the security features of a CRM before committing.

3. Can a CRM integrate with my existing tools?

Many CRMs offer integrations with common tools like email clients, calendars, and other software. This enhances efficiency by creating a seamless workflow.

4. What is the cost of implementing a CRM system?

Costs vary widely depending on the CRM’s features and the number of users. Some offer basic plans suitable for individual agents, while others have more comprehensive packages for larger teams.

5. How long does it take to set up a CRM?

Setup time can range from a few hours to several weeks, depending on the complexity of your needs and the CRM’s user-friendliness. CRMs with intuitive interfaces typically require less time to get up and running.

6. Is training required to use a CRM effectively?

While some CRMs are very user-friendly, investing time in training can help you leverage all the features effectively, maximizing your return on investment.

7. Can I customize the CRM to fit my business?

Yes, many CRMs offer customization options. You can tailor fields, workflows, and reports to match your specific business processes.

8. Will a CRM help with regulatory compliance?

Certain CRMs designed for the insurance industry include features that help you stay compliant with industry regulations, such as secure data handling and audit trails.

9. Can I access the CRM on mobile devices?

Most modern CRMs offer mobile apps or mobile-responsive designs, allowing you to access client information on the go.

10. What kind of customer support can I expect?

Support varies by provider but can include live chat, email support, phone assistance, and extensive online resources like FAQs and tutorials.

By carefully considering your options and utilizing the resources available, you can select the best CRM for life insurance agents that will support and enhance your business operations.

I’m Palash Pramanik, an SEO and CRM expert with a deep passion for helping businesses thrive online. I specialize in driving higher search engine rankings and creating seamless customer relationship management strategies to enhance both visibility and engagement. Whether you need to boost your online presence, attract the right audience, or streamline your client interactions, I offer tailored solutions designed to meet your specific needs. My goal is to help you optimize your digital strategy, strengthen customer connections, and drive sustainable growth. Let’s work together to elevate your business to new heights!