Did you know that businesses using a CRM system experience a 29% increase in sales? In today’s competitive landscape, managing customer relationships effectively is not just an advantage—it’s a necessity. For tax professionals, who deal with sensitive client information and intricate workflows, selecting the right Customer Relationship Management (CRM) system can be a game-changer.

In this comprehensive guide, I aim to explore the best CRM for tax professionals, comparing top solutions tailored to meet the unique needs of this industry. We’ll delve into essential features, pricing structures, and ideal use cases to help you make an informed decision that enhances your client interactions and streamlines your operations.

Choosing the right CRM is pivotal for achieving business success. It not only aids in customer retention by providing personalized experiences but also streamlines your operations, allowing you to focus more on delivering exceptional tax services. A well-implemented CRM can transform how you manage client relationships, track interactions, and automate mundane tasks, ultimately boosting your efficiency and profitability.

This article will cover everything you need to know about selecting the best CRM for tax professionals. From understanding the critical features to evaluating pricing and use cases, we’ll provide a detailed overview to ensure you choose a solution that aligns perfectly with your business needs.

What to Look for in a CRM for Your Business

Scalability

As your tax practice grows, so will your data and the number of users accessing your CRM. It’s crucial to choose a CRM that can scale seamlessly with your business. Look for solutions that offer flexible pricing tiers, allowing you to add more users or features as needed without significant disruptions or costs. A scalable CRM ensures that you won’t outgrow your system, saving you the hassle of migrating to a new platform down the line.

Ease of Use

Time is of the essence for tax professionals, especially during peak seasons. An intuitive interface and a straightforward onboarding process can significantly reduce the time spent on training and increase overall productivity. The best CRM systems are user-friendly, requiring minimal technical expertise to navigate. This ease of use ensures that your team can quickly adapt to the new system, minimizing downtime and maximizing efficiency.

Customization

Every tax practice has its unique workflows and requirements. A one-size-fits-all CRM often falls short in addressing specific business needs. Therefore, it’s essential to choose a CRM that offers customizable features. Whether it’s tailored reporting, specialized client tracking, or unique workflow automation, customization ensures that the CRM aligns perfectly with your operational processes, enhancing overall effectiveness.

5 Best CRM Solutions for Tax Professionals

1. HubSpot CRM

HubSpot CRM is a widely used, comprehensive customer relationship management tool that caters to businesses of all sizes. It offers a user-friendly interface and powerful tools for managing client interactions, making it ideal for tax professionals looking to streamline their client management and marketing efforts.

Key Features:

- Contact Management: Easily organize and track client information, including tax documents and communications.

- Email Integration: Sync with email accounts for seamless correspondence with clients.

- Automated Workflows: Automate repetitive tasks such as client follow-ups or tax filing reminders, improving productivity.

- Reporting and Analytics: Track key metrics, such as client retention rates and conversion stats, helping tax professionals analyze business performance.

- Task Management: Assign and track tasks, making collaboration easier within tax teams.

- Customizable Dashboards: Tailor dashboards to display relevant tax-related metrics.

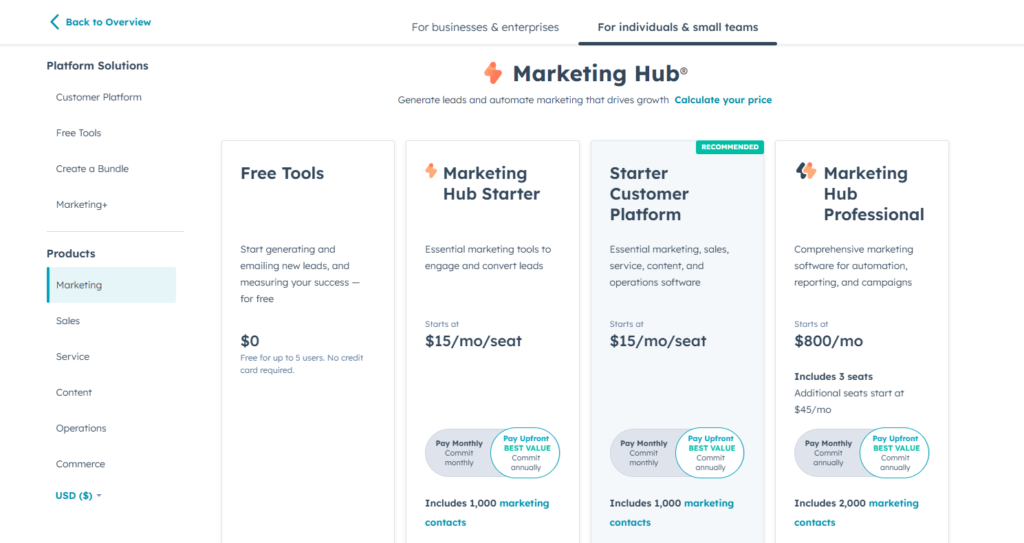

Pricing:

- Free Plan: $0 for core features like contact management and reporting.

- Starter: $15/month (additional marketing and automation features).

- Professional: $800/month (advanced automation, reporting, and team collaboration tools).

- Enterprise: $3,600/month (includes advanced customizations, permissions, and support).

Small to mid-sized tax firms that need an easy-to-use CRM with essential features like email integration, contact management, and task automation. Ideal for firms focused on growing their client base and improving client interactions through automation.

2. Pipedrive CRM

Pipedrive is a sales-focused CRM designed to streamline client management and improve workflow efficiency. It is highly visual and intuitive, making it easier for tax professionals to track client interactions and prioritize tasks. It’s particularly helpful for professionals looking to manage multiple client pipelines and leads simultaneously.

Key Features:

- Pipeline Management: Visually track clients and tax filings across different stages, making it easier to manage deadlines.

- Activity Reminders: Schedule follow-up tasks and client meetings, ensuring nothing is missed during tax season.

- Email Integration: Sync emails to centralize communications, helping tax professionals stay organized with client correspondence.

- Customizable Fields: Tailor fields to store specific tax-related data, ensuring every client’s information is structured for easy access.

- Automation: Automate repetitive tasks like sending tax filing reminders or scheduling calls, saving time.

- Reporting and Insights: Generate detailed reports on client interactions and overall business performance to make informed decisions.

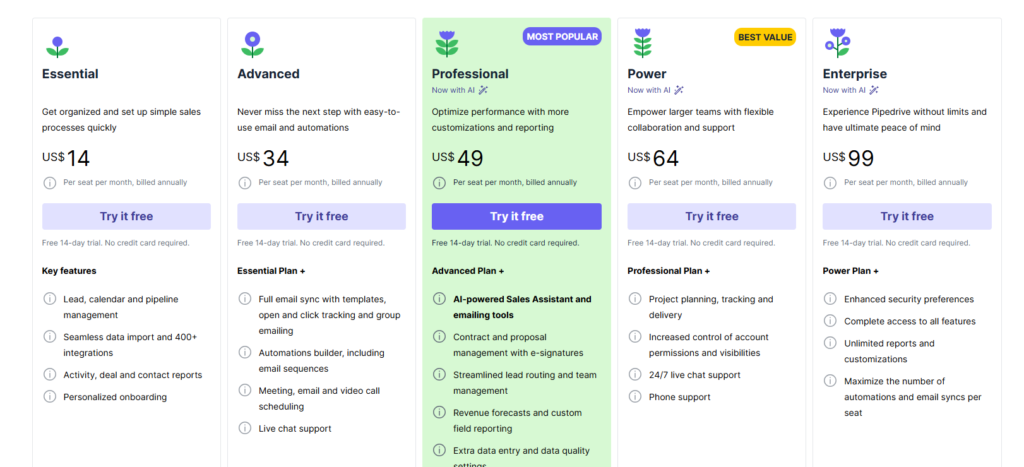

Pricing:

- Essential Plan: $14/month per user (basic pipeline management and contact tracking).

- Advanced Plan: $34/month per user (email sync, workflow automation).

- Professional Plan: $49/month per user (advanced reporting, custom fields).

- Power Plan: $64/month per user (team management, custom permissions).

- Enterprise Plan: $99/month per user (advanced customizations and support).

Small to mid-sized tax firms or individual tax professionals who need strong pipeline management and automation features to keep track of multiple clients and deadlines efficiently. Ideal for those who manage complex tax projects with frequent follow-ups.

\

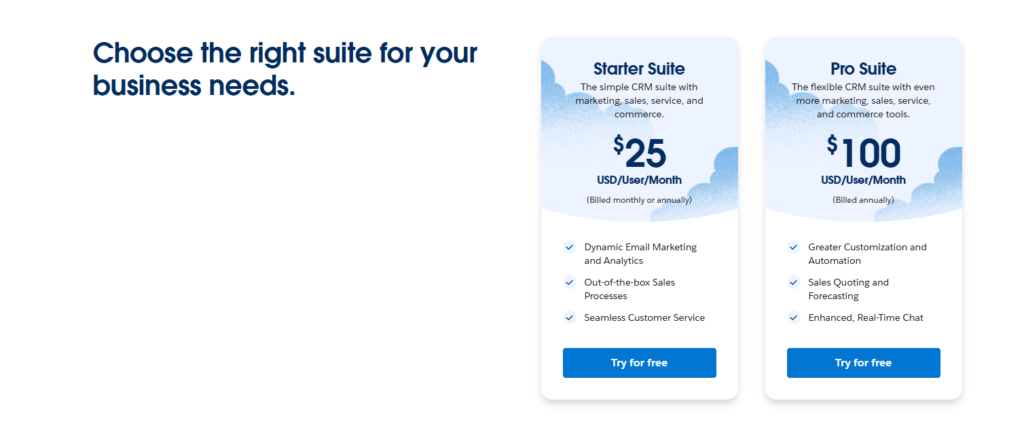

3. Salesforce CRM

Salesforce is one of the most robust and customizable CRMs on the market, designed for businesses of all sizes. It offers an extensive range of features and integrations, making it an all-in-one solution for managing client relationships, automating processes, and enhancing productivity. For tax professionals, Salesforce provides scalable tools to handle both individual clients and large corporate accounts efficiently.

Key Features:

- Client Management: Keep all client tax-related information in one place, with detailed records and notes.

- Customizable Workflows: Automate complex tax processes like document collection, filing reminders, and status updates for each client.

- Advanced Reporting and Analytics: Generate custom reports on client trends, financial performance, and deadlines, helping tax professionals optimize services.

- Email and Communication Integration: Sync all communications across platforms to stay on top of client correspondence and inquiries.

- Lead and Opportunity Tracking: Manage new business leads effectively, ensuring no potential tax clients are missed.

- Third-party Integrations: Seamlessly integrate with accounting and tax filing software for smoother operations.

Large tax firms or tax professionals handling complex client portfolios, particularly those needing extensive customization and scalability. It’s ideal for tax professionals working with multiple teams or departments and seeking advanced automation and data analysis capabilities.

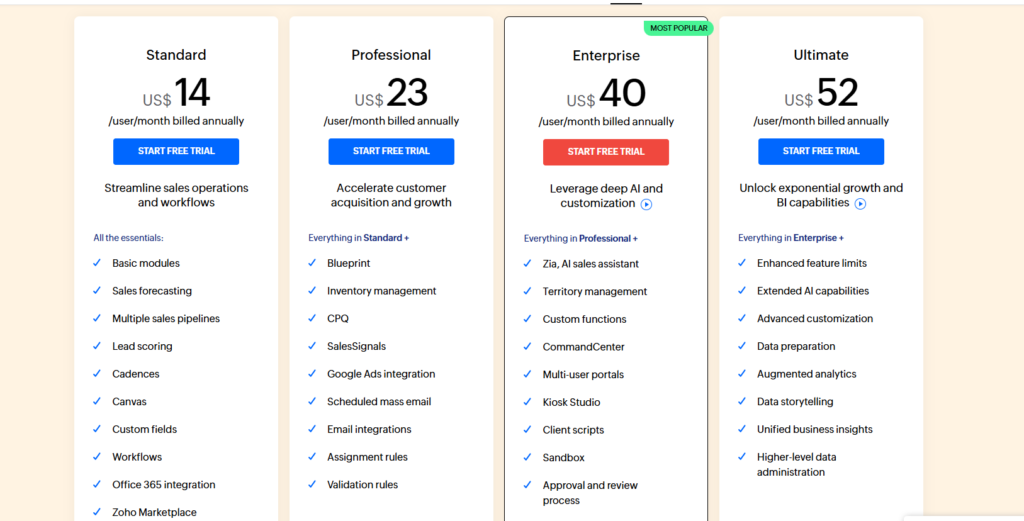

4. Zoho CRM

Zoho CRM is a flexible and affordable CRM solution designed for businesses of all sizes. It offers a range of customizable tools to help manage client interactions, automate workflows, and enhance overall productivity. For tax professionals, Zoho CRM provides essential features to manage client information, track tax deadlines, and automate communication.

Key Features:

- Contact Management: Easily store and access detailed client tax information, communication history, and documents.

- Workflow Automation: Automate routine tasks like tax filing reminders, follow-up emails, and client status updates, saving time during tax season.

- Customizable Dashboards: Set up dashboards to track key metrics like tax filing progress and client status.

- Email Integration and Templates: Sync emails and use pre-built templates for common tax communications, ensuring consistency and saving time.

- Sales and Opportunity Tracking: Keep track of potential clients and leads to grow your tax practice.

- Advanced Analytics: Generate reports to analyze client patterns, deadlines, and overall business performance.

Small to mid-sized tax professionals or firms looking for an affordable, highly customizable CRM. Ideal for those who need strong automation and contact management features to keep up with client interactions, deadlines, and tax filing processes while scaling their business.

5. Keap CRM

Keap (formerly Infusionsoft) is a CRM designed for small businesses, with a focus on simplifying client management, sales, and marketing automation. It offers an all-in-one solution for handling client communications, invoicing, and workflow automation, making it particularly useful for tax professionals looking to streamline their operations and improve client relationships.

Key Features:

- Client Management: Centralize all client information, including tax records and communications, for easy access and better organization.

- Automation and Workflow Tools: Automate repetitive tasks such as tax reminders, follow-ups, and scheduling, reducing manual effort and saving time.

- Invoicing and Payments: Generate invoices and accept payments directly within the CRM, simplifying billing for tax professionals.

- Email Marketing Automation: Create email campaigns to send regular updates or reminders to clients during tax season, keeping communication consistent.

- Appointments and Scheduling: Use built-in scheduling tools to manage client meetings, improving overall time management during busy tax periods.

- Sales Pipeline Management: Track the status of clients, leads, and referrals through customizable pipelines.

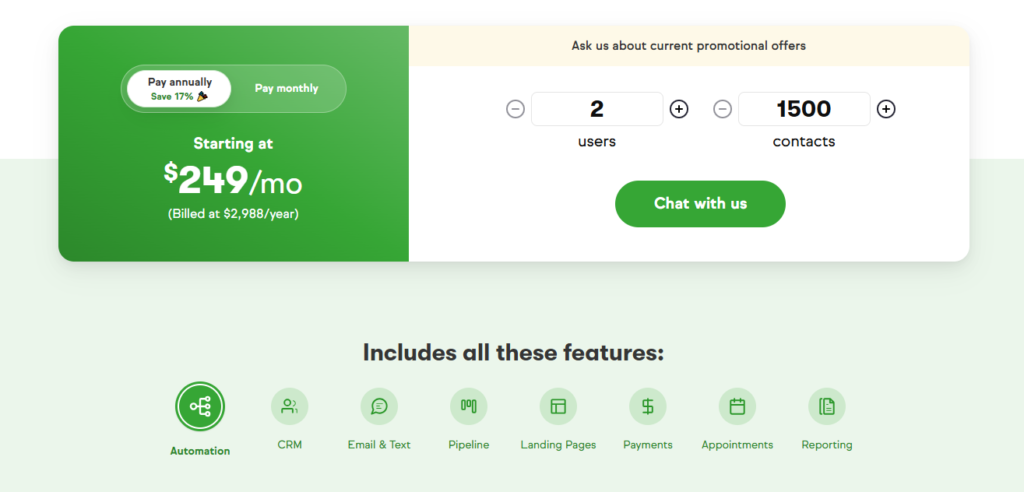

Pricing:

- Pro Plan: $249/month for 1,500 contacts and 2 users (includes automation, invoicing, payments, email marketing, and scheduling tools).

Small tax firms or solo practitioners who need a CRM with strong automation and invoicing features. It’s especially useful for tax professionals focused on growing their client base and improving communication, while simplifying billing and follow-up processes through automation.

Which CRM is Best for Your Tax Practice?

After a thorough evaluation, Salesforce stands out as the best CRM for tax professionals. Its robust feature set, extensive customization options, and scalability make it an ideal choice for growing tax practices. Salesforce’s powerful automation tools and comprehensive reporting capabilities provide tax professionals with the insights needed to enhance client relationships and streamline operations.

Use Case Recommendations

- Small to Medium Tax Firms: Zoho CRM offers a cost-effective solution with essential features tailored for smaller teams, making it an excellent choice for firms looking to balance functionality and affordability.

- Startups and New Tax Professionals: HubSpot CRM is perfect for those just starting, offering a free tier with ample features to get your CRM needs met without a significant financial commitment.

- Established Firms with Complex Needs: Salesforce and TaxPro CRM are well-suited for larger firms that require advanced customization, integration capabilities, and comprehensive support to manage intricate workflows and large client bases.

Next Steps

Ready to enhance your tax practice with the best CRM solution? Start by identifying your specific needs and budget constraints. Take advantage of free trials and demos offered by the recommended CRM providers to experience their features firsthand. This hands-on approach will help you determine which CRM aligns best with your business goals and operational requirements.

How to Choose a CRM: A Beginner’s Buying Guide for Tax Professionals

Step-by-Step Guidance

- Identify Your Business Needs:

- Assess your current processes and identify areas where a CRM can add value.

- Determine the essential features you require, such as client management, appointment scheduling, or automated reminders.

- Evaluate Features:

- Look for features that cater specifically to tax professionals, like secure document storage, integration with accounting software, and compliance management.

- Consider the importance of mobile access and user-friendly interfaces for your team.

- Consider Budget Constraints:

- Define your budget and explore CRM options within that range.

- Evaluate the cost-effectiveness by considering both upfront and ongoing expenses, such as subscription fees and additional feature costs.

- Assess Customization and Scalability:

- Ensure the CRM can be tailored to your unique workflows and can grow with your business.

- Check if the CRM allows for easy addition of users and features as your practice expands.

- Review Customer Support:

- Opt for CRM providers that offer robust customer support, including training resources, responsive help desks, and comprehensive documentation.

- Consider the availability of support channels like phone, email, and live chat.

- Test with Free Trials:

- Utilize free trials or demo versions to explore the CRM’s functionality and usability.

- Involve your team in testing to gather feedback and ensure the CRM meets everyone’s needs.

- Check Integration Capabilities:

- Ensure the CRM can seamlessly integrate with your existing tools and software, such as accounting platforms, email services, and document management systems.

- Integration reduces manual data entry and enhances workflow efficiency.

- Security and Compliance:

- Prioritize CRM systems that offer robust security features, including data encryption, secure access controls, and regular backups.

- Ensure the CRM complies with relevant regulations, such as GDPR or other data protection laws, to safeguard client information.

Conclusion

Recap

Selecting the best CRM for tax professionals is a critical decision that can significantly impact your business’s efficiency and client satisfaction. We explored key factors to consider, including scalability, ease of use, and customization, and reviewed top CRM solutions like Salesforce, Zoho CRM, HubSpot CRM, Freshsales, Keap, and TaxPro CRM. Each of these platforms offers unique features tailored to meet the diverse needs of tax professionals.

Final Thoughts

When choosing a CRM, it’s essential to consider not just your current needs but also your long-term business goals. A scalable and customizable CRM will support your growth and adapt to evolving requirements, ensuring sustained success. Investing in the right CRM system is an investment in your business’s future, enabling you to build stronger client relationships and streamline your operations effectively.

FAQs

Do I really need a CRM?

Absolutely. A CRM system helps you manage client relationships more effectively, streamline your operations, and improve overall efficiency. For tax professionals, it means better client management, timely follow-ups, and organized workflows, all of which contribute to enhanced client satisfaction and business growth.

How secure is my data in a CRM?

Data security is a top priority for reputable CRM providers. They employ advanced security measures, including data encryption, secure access controls, and regular backups, to protect your sensitive information. Always choose a CRM that complies with industry standards and regulations to ensure your data remains safe.

Can a CRM integrate with my existing tools?

Most modern CRM systems offer extensive integration capabilities with a wide range of tools and software, including accounting platforms, email services, and document management systems. This seamless integration helps streamline your workflows and reduces the need for manual data entry.

What is the cost of implementing a CRM system?

The cost of a CRM system varies depending on the provider, the features you need, and the number of users. CRM solutions typically offer tiered pricing plans to accommodate different budgets and business sizes. It’s essential to evaluate the total cost of ownership, including subscription fees, setup costs, and any additional charges for premium features.

How long does it take to set up a CRM?

The setup time for a CRM system depends on the complexity of your requirements and the CRM’s customization capabilities. Generally, it can take anywhere from a few days to several weeks. Utilizing a CRM with an intuitive interface and robust support can significantly reduce the setup time, allowing you to start reaping the benefits sooner.

Can a CRM help with client retention?

Yes, a CRM system enhances client retention by enabling personalized communication, timely follow-ups, and better service management. By keeping track of client interactions and preferences, a CRM helps you build stronger relationships and respond more effectively to your clients’ needs.

Is training required to use a CRM?

While many CRM systems are designed to be user-friendly, some training is often beneficial to maximize their potential. Most CRM providers offer training resources, including tutorials, webinars, and customer support, to help you and your team get up to speed quickly.

What features should I prioritize in a CRM for tax professionals?

Key features to prioritize include secure document storage, integration with accounting software, automated reminders, customizable reporting, and robust data security. These features address the specific needs of tax professionals, ensuring efficient client management and compliance with industry regulations.

Can a CRM improve my workflow efficiency?

Absolutely. A CRM system automates routine tasks, organizes client information, and streamlines communication, all of which contribute to improved workflow efficiency. By reducing manual data entry and providing a centralized platform for managing client interactions, a CRM allows you to focus more on delivering quality tax services.

How does a CRM support compliance?

A CRM can support compliance by securely storing client data, tracking interactions, and maintaining detailed records. Features like audit trails, data encryption, and role-based access controls help ensure that your practice adheres to industry regulations and data protection laws, safeguarding both your business and your clients.

By following this optimized guide, you are well-equipped to select the best CRM for tax professionals, ensuring your practice remains efficient, compliant, and client-focused. Investing in the right CRM system is a strategic decision that can drive your business forward, enhance client relationships, and streamline your operations for long-term success.

I’m Rejaul Karim, an SEO and CRM expert with a passion for helping small businesses grow online. I specialize in boosting search engine rankings and streamlining customer relationship management to make your business run smoothly. Whether it's improving your online visibility or finding better ways to connect with your clients, I'm here to provide simple, effective solutions tailored to your needs. Let's take your business to the next level!